Possible Bearish Signals With BigCommerce Holdings Insiders Disposing Stock

Possible Bearish Signals With BigCommerce Holdings Insiders Disposing Stock

BigCommerce Holdings, Inc. (NASDAQ:BIGC) shareholders may have reason to be concerned, as several insiders sold their shares over the past year. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

BigCommerce 控股有限公司 納斯達克股票代碼:BIGC)的股東可能有理由擔心,因爲在過去的一年中,有幾位內部人士出售了他們的股票。在評估內幕交易時,了解內部人士是否買入通常更有幫助,因爲內幕拋售可能有多種解釋。但是,當多位內部人士在特定期限內出售股票時,股東應注意,因爲這可能是一個危險信號。

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

儘管在長期投資中,內幕交易並不是最重要的事情,但我們認爲完全忽視內幕交易是愚蠢的。

Check out our latest analysis for BigCommerce Holdings

查看我們對BigCommerce Holdings的最新分析

The Last 12 Months Of Insider Transactions At BigCommerce Holdings

BigCommerce Holdings 過去 12 個月的內幕交易

In the last twelve months, the biggest single sale by an insider was when the Chairman & CEO, Brent Bellm, sold US$238k worth of shares at a price of US$7.47 per share. That means that an insider was selling shares at slightly below the current price (US$8.94). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 1.5% of Brent Bellm's stake.

在過去的十二個月中,內部人士最大的一次拋售是董事長兼首席執行官布倫特·貝爾姆以每股7.47美元的價格出售了價值23.8萬美元的股票。這意味着一位內部人士以略低於當前價格(8.94美元)的價格出售股票。當內部人士以低於當前價格的價格賣出時,這表明他們認爲較低的價格是公平的。這讓我們想知道他們如何看待最近(更高)的估值。但是,請注意,賣家可能有多種出售理由,因此我們不確定他們對股票價格的看法。此次出售僅佔布倫特·貝爾姆股份的1.5%。

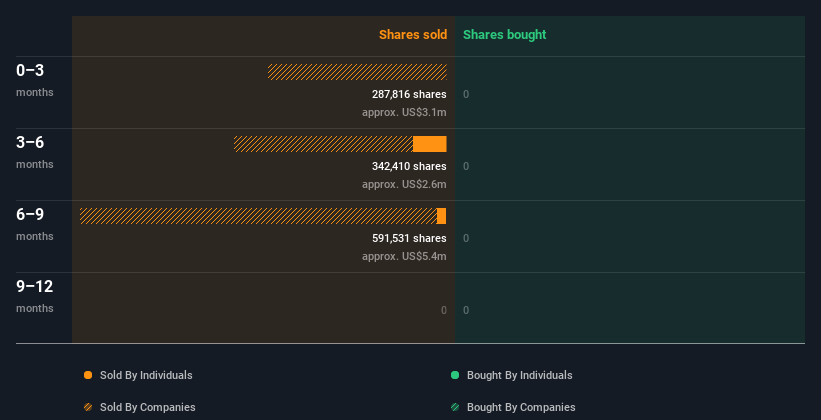

Insiders in BigCommerce Holdings didn't buy any shares in the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

去年,BigCommerce Holdings的內部人士沒有購買任何股票。下圖顯示了去年的內幕交易(按公司和個人劃分)。如果你點擊圖表,你可以看到所有的個人交易,包括股價、個人和日期!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你和我一樣,那麼你會 不 想錯過這個 免費的 內部人士正在收購的成長型公司名單。

Does BigCommerce Holdings Boast High Insider Ownership?

BigCommerce Holdings 是否擁有很高的內部

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. BigCommerce Holdings insiders own about US$84m worth of shares. That equates to 13% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

查看公司的內幕持股總量可以幫助你了解他們是否與普通股股東保持一致。內部人士的高度所有權通常會使公司領導層更加關注股東利益。BigCommerce Holdings內部人士擁有價值約8400萬美元的股票。這相當於該公司的13%。儘管內部所有權水平很高,但並不突出,但這足以表明管理層與小股東之間存在一定的一致性。

What Might The Insider Transactions At BigCommerce Holdings Tell Us?

BigCommerce Holdings的內幕交易會告訴我們什麼?

The fact that there have been no BigCommerce Holdings insider transactions recently certainly doesn't bother us. Our analysis of BigCommerce Holdings insider transactions leaves us cautious. But we do like the fact that insiders own a fair chunk of the company. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 2 warning signs for BigCommerce Holdings you should be aware of.

最近沒有BigCommerce Holdings的內幕交易,這一事實當然不會打擾我們。我們對BigCommerce Holdings內幕交易的分析讓我們保持謹慎但是我們確實喜歡這樣一個事實,即內部人士擁有公司的相當一部分股份。雖然我們想知道內部人士的所有權和交易發生了什麼,但我們一定要在做出任何投資決定之前考慮股票面臨的風險。一個很好的例子:我們發現了 大商控股有 2 個警告信號 你應該知道。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

當然, 你可能會在其他地方找到一筆不錯的投資。 所以來看看這個 免費的 有趣的公司名單。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,內部人士是指向相關監管機構報告其交易的個人。我們目前只考慮公開市場交易和私下處置的直接利益,不包括衍生品交易或間接權益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。

In the last twelve months, the biggest single sale by an insider was when the Chairman & CEO, Brent Bellm, sold US$238k worth of shares at a price of US$7.47 per share. That means that an insider was selling shares at slightly below the current price (US$8.94). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 1.5% of Brent Bellm's stake.

In the last twelve months, the biggest single sale by an insider was when the Chairman & CEO, Brent Bellm, sold US$238k worth of shares at a price of US$7.47 per share. That means that an insider was selling shares at slightly below the current price (US$8.94). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 1.5% of Brent Bellm's stake.