Due to the recovery of downstream demand, lithium diaphragm leading star source material revenue, net profit have rebounded.

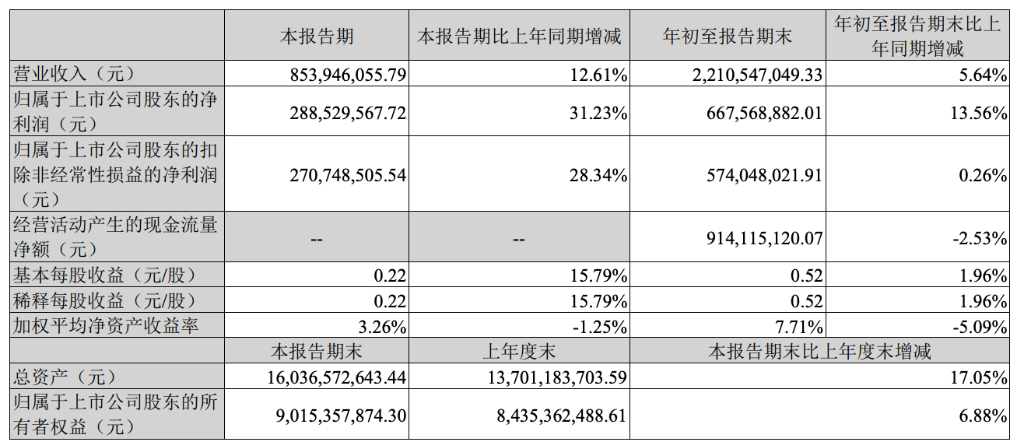

On the evening of October 16, lithium diaphragm leader Xingyuan material disclosed its third-quarter results, which showed that the company's revenue in the third quarter was 854 million yuan, an increase of 12.61% over the same period last year, and its operating income in the first three quarters was 2.211 billion yuan, an increase of 5.64% over the same period last year. The net profit in the third quarter was 289 million yuan, up 31.23% from the same period last year, and 668 million yuan in the first three quarters, an increase of 13.56% over the same period last year. Basic earnings per share is 0.52 yuan.

In the third quarter, the gross profit margin of Xingyuan material was 45.85%, up 4% from the same period last year, 0.42% from the previous year, and the net profit rate was 31.06%, up 1.74% from the same period last year and 1.71% from the previous year. Xingyuan material mainly engaged in lithium-ion battery diaphragm research and development, production and sales. According to the financial report, the diaphragm of lithium-ion battery accounts for 99.34% of operating income.

In the third quarter, the gross profit margin of Xingyuan material was 45.85%, up 4% from the same period last year, 0.42% from the previous year, and the net profit rate was 31.06%, up 1.74% from the same period last year and 1.71% from the previous year. Xingyuan material mainly engaged in lithium-ion battery diaphragm research and development, production and sales. According to the financial report, the diaphragm of lithium-ion battery accounts for 99.34% of operating income.

Xingyuan material said at the previous performance meeting that the company's biggest competitor has always been itself, and the main problem it faces is insufficient production capacity.It can not fully meet the demand for the company's products in the middle and high-end market of the diaphragm industry.. Due to the high barriers in the production technology of the diaphragm industry, the cycle of production line construction and product introduction is relatively long, the supply of high-end production capacity in the diaphragm market is still insufficient.

Chen Xiufeng, chairman of Xingyuan material, said earlier that there was only backward production capacity and no excess products. Chen Xiufeng believes that in the long run, high-end, high-quality, low-cost products are still scarce, and the middle and high-end diaphragm capacity is still insufficient. With the development of the industry, some backward production capacity will be eliminated, and the market will have a round of reshuffle.

Research institute Xinhuo Lithium pointed out that the downturn in the domestic lithium electricity market has challenged the diaphragm industry. The destocking of lithium battery manufacturers has led to few orders from material manufacturers, and the sharp decline in capacity utilization has led to a price war in a certain range. However, the leading manufacturers are the first to get out of the market haze in the relatively harsh market environment. meanwhile,The fifth generation wet production line will be mass-produced, and technological cost reduction is expected to ensure stable profits.

三季度星源材质毛利率为45.85%,同比提升4%,环比提升0.42%,归母净利率31.06%,同比上涨1.74%,环比增长1.71%。星源材质主营锂离子电池隔膜研发、生产及销售。财报显示,锂离子电池隔膜占营业收入比达到99.34%。

三季度星源材质毛利率为45.85%,同比提升4%,环比提升0.42%,归母净利率31.06%,同比上涨1.74%,环比增长1.71%。星源材质主营锂离子电池隔膜研发、生产及销售。财报显示,锂离子电池隔膜占营业收入比达到99.34%。