下流市場の需要が急速に増加しているため、算力のリーディングカンパニーである海光情報は第3四半期に高い成長率を維持しています。

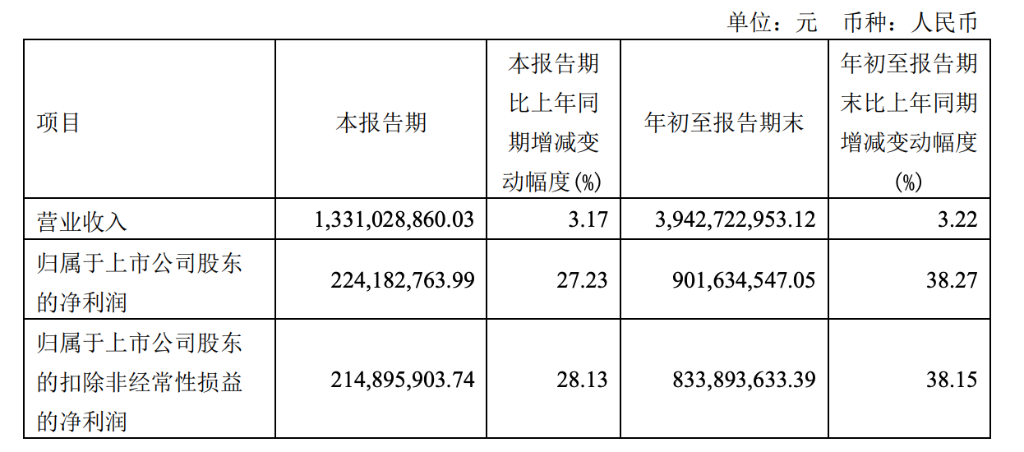

10月17日の夜、海光情報は第3四半期の財務諸表を発表し、2023年前半年の売上高は約39.43億元で、前年同期比3.22%増加しました。純利益は約9.02億元で、前年同期比38.27%増加しました。第3四半期の売上高は13.33億元で、前年同期比3.3%増加し、第3四半期の純利益は2.24億元で、前年同期比27.23%増加しました。

コスト側から見ると、海光情報の第3四半期の研究開発投資は7.3億元で、前年同期比48%増加しました。主な理由は、研究開発プロジェクトの進捗が加速し、検証段階に入ったプロジェクトが多くなり、技術サービス費用や検証試験材料費が大幅に増加したため、投資の強度が持続的に増加したためです。研究開発投資は売上高の比率を16.7%増加し、54.88%になりました。

コスト側から見ると、海光情報の第3四半期の研究開発投資は7.3億元で、前年同期比48%増加しました。主な理由は、研究開発プロジェクトの進捗が加速し、検証段階に入ったプロジェクトが多くなり、技術サービス費用や検証試験材料費が大幅に増加したため、投資の強度が持続的に増加したためです。研究開発投資は売上高の比率を16.7%増加し、54.88%になりました。

海光情報は前回の財務諸表で、高級汎用プロセッサ(CPU)と協調プロセッサ(DCU)の両方の開発能力を持つ国内の数少ない集積回路設計企業の一つとして、常にサーバーやワークステーションなどのコンピューターおよびストレージ機器に適用される高級プロセッサーの研究開発、設計、販売に注力しており、完璧な高級プロセッサーの研究開発環境とプロセスを確立し、製品の性能は世代ごとに向上し、機能は常に向上しています。

平安証券によると、AMDのx86およびZenアーキテクチャのライセンス使用により、海光情報は関連するチップ設計能力を徐々に備え、サーバーやワークステーションなどの分野で関連する製品を展開しています。

9月20日の機関調査によると、海光情報は深洞2号をリリースし、ビッグデータ処理、人工知能、ビジネス計算などの分野で商用化を実現し、深算3号の研究開発も順調に進んでいます。同社の次世代CPU製品には海光4号、海光5号などがあります。

中信証券は、AI時代の算術需要の増加により、海光情報は2023年第3四半期に深洞2号を導入して市場のニーズに対応しています。2023年9月以降、大手銀行数社が信用創造型サーバー中標の発表を続け、業界の信用創造型開発は上半期の一時的な鈍化を経て再び加速しています。

現在、海光CPUは、国内信用創造型サーバーCPU市場で最大のシェアの1つであり、x86命令セットをベースにした数百万のシステムソフトウェアやアプリケーションソフトウェアと簡単に互換性があります。会社の中間報告書によると、次世代CPU製品である海光4号、海光5号の開発が順調に進んでおり、将来的に同社は信用創造型CPU市場でのリーディングカンパニーの地位を維持することができます。

10月17日の取引終了時点で、海光情報の株価は1.25%以上上昇し、52.54元に達し、時価総額は1221億元に達しました。

从费用端看,海光信息第三季度研发投入7.3亿,同比增长48%。主要原因为在研项目实施进度加快,进入验证阶段项目较多,技术服务费及验证测试材料费增加较多,投入力度持续加大;研发投入占营业收入的比例增加16.7%至54.88%。

从费用端看,海光信息第三季度研发投入7.3亿,同比增长48%。主要原因为在研项目实施进度加快,进入验证阶段项目较多,技术服务费及验证测试材料费增加较多,投入力度持续加大;研发投入占营业收入的比例增加16.7%至54.88%。