If you love investing in stocks you're bound to buy some losers. But long term Chongqing Fuling Zhacai Group Co., Ltd. (SZSE:002507) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 59% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 22% in the last year. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days.

If the past week is anything to go by, investor sentiment for Chongqing Fuling Zhacai Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Chongqing Fuling Zhacai Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Chongqing Fuling Zhacai Group actually managed to grow EPS by 3.0% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. However, taking a look at other business metrics might shed a bit more light on the share price action.

The modest 1.9% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 5.6% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Chongqing Fuling Zhacai Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

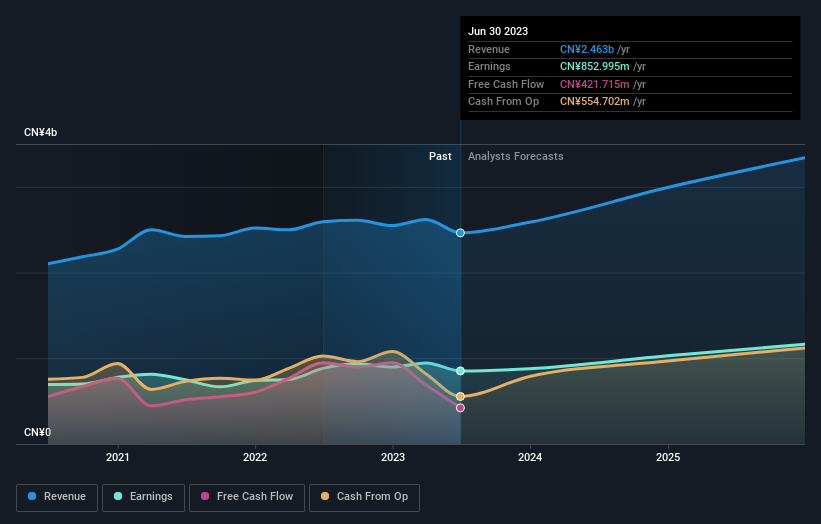

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Chongqing Fuling Zhacai Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Chongqing Fuling Zhacai Group stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market lost about 3.4% in the twelve months, Chongqing Fuling Zhacai Group shareholders did even worse, losing 21% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Chongqing Fuling Zhacai Group you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course Chongqing Fuling Zhacai Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.