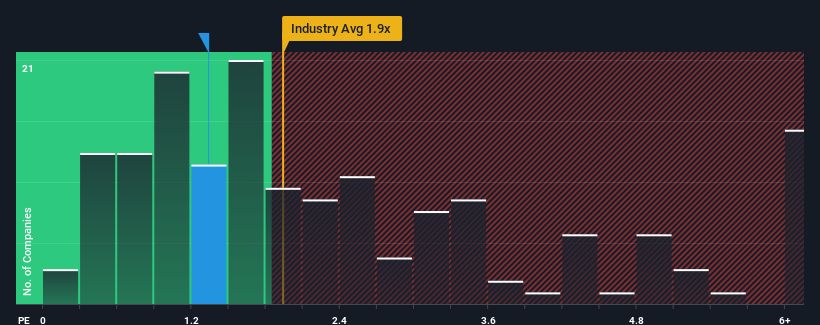

Royal Group Co.,Ltd.'s (SZSE:002329) price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Food industry in China, where around half of the companies have P/S ratios above 1.9x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Royal GroupLtd

What Does Royal GroupLtd's P/S Mean For Shareholders?

Royal GroupLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Royal GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Royal GroupLtd's earnings, revenue and cash flow.How Is Royal GroupLtd's Revenue Growth Trending?

Royal GroupLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Royal GroupLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Pleasingly, revenue has also lifted 48% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Royal GroupLtd's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Royal GroupLtd's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Royal GroupLtd currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Having said that, be aware Royal GroupLtd is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.