First Ship Lease Trust (SGX:D8DU) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

First Ship Lease Trust (SGX:D8DU) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

First Ship Lease Trust (SGX:D8DU) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

第一艘船租赁信托 新加坡证券交易所股票代码:D8DU)等待某件事发生的股东在上个月股价下跌了25%,这给他们带来了打击。在过去十二个月中已经持有的股东没有获得回报,反而股价下跌了38%。

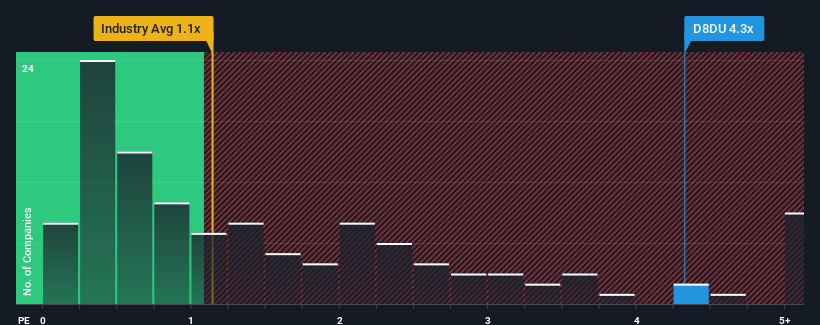

In spite of the heavy fall in price, when almost half of the companies in Singapore's Shipping industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider First Ship Lease Trust as a stock not worth researching with its 4.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

尽管价格大幅下跌,但当新加坡航运业中将近一半的公司的市售比率(或 “P/S”)低于1.9倍时,您仍然可以将First Ship Lease Trust视为不值得研究的股票,其市盈率为4.3倍。但是,市盈率可能很高是有原因的,需要进一步调查才能确定是否合理。

See our latest analysis for First Ship Lease Trust

查看我们对第一艘船租赁信托的最新分析

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023

新加坡证券交易所:D8DU 市销比率与行业对比 2023 年 10 月 22 日

What Does First Ship Lease Trust's P/S Mean For Shareholders?

First Ship Lease Trust的市盈率对股东意味着什么?

For example, consider that First Ship Lease Trust's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

例如,考虑一下,由于收入下降,First Ship Lease Trust最近的财务表现一直很差。也许市场认为,该公司可以做得足够多,在不久的将来跑赢该行业的其他公司,这使市盈率保持在较高的水平。如果不是,那么现有股东可能会对股价的可行性感到非常紧张。

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on First Ship Lease Trust will help you shine a light on its historical performance.

想全面了解公司的收益、收入和现金流吗?然后我们的 免费的 关于First Ship Lease Trust的报告将帮助你了解其历史表现。

Is There Enough Revenue Growth Forecasted For First Ship Lease Trust?

预计第一艘船租赁信托的收入增长是否足够?

The only time you'd be truly comfortable seeing a P/S as steep as First Ship Lease Trust's is when the company's growth is on track to outshine the industry decidedly.

你唯一能真正放心地看到像First Ship Lease Trust这样高涨的市盈率的时候,是该公司的增长有望绝对超越整个行业。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. This means it has also seen a slide in revenue over the longer-term as revenue is down 79% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的42%的下降。这意味着从长远来看,它的收入也有所下滑,因为在过去三年中,总收入下降了79%。因此,股东们会对中期收入增长率感到悲观。

Comparing that to the industry, which is predicted to shrink 17% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

与该行业相比,该行业预计将在未来12个月内萎缩17%,根据最近的中期年化收入业绩,该公司的下行势头仍然不佳。

In light of this, it's odd that First Ship Lease Trust's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

有鉴于此,奇怪的是,First Ship Lease Trust的市盈率高于大多数其他公司。由于收入迅速逆转,还不能保证市盈率会达到下限。如果该公司不改善收入增长,市盈率有可能降至较低水平,而当前的行业前景很难做到这一点。

The Bottom Line On First Ship Lease Trust's P/S

First Ship Lease Trust P/S 的底线

First Ship Lease Trust's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

First Ship Lease Trust的股票可能遭受了损失,但其市盈率仍然很高。通常,在确定投资决策时,我们谨慎行事,不要过多地阅读市售比率,尽管这可以充分揭示其他市场参与者对公司的看法。

Our examination of First Ship Lease Trust revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我们对First Ship Lease Trust的调查显示,鉴于该行业的萎缩幅度将不那么严重,其三年收入急剧萎缩对其高市盈率的影响并没有我们预期的那么大。目前,我们对高市盈率并不满意,因为这种收入表现不太可能长期支持这种积极的情绪。此外,我们担心在这些艰难的行业条件下,该公司能否维持其中期业绩水平。这将使股东的投资面临重大风险,潜在投资者面临支付过高溢价的危险。

We don't want to rain on the parade too much, but we did also find 2 warning signs for First Ship Lease Trust that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也发现了 第一船租赁信托基金的 2 个警告标志 这是你需要注意的。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果实力雄厚的公司让你大开眼界,那么你一定要看看这个 免费的 以低市盈率交易(但已证明可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 请直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023