First Ship Lease Trust (SGX:D8DU) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

First Ship Lease Trust (SGX:D8DU) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

First Ship Lease Trust (SGX:D8DU) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

第一艘船租賃信託 新加坡證券交易所股票代碼:D8DU)等待某件事發生的股東在上個月股價下跌了25%,這給他們帶來了打擊。在過去十二個月中已經持有的股東沒有獲得回報,反而股價下跌了38%。

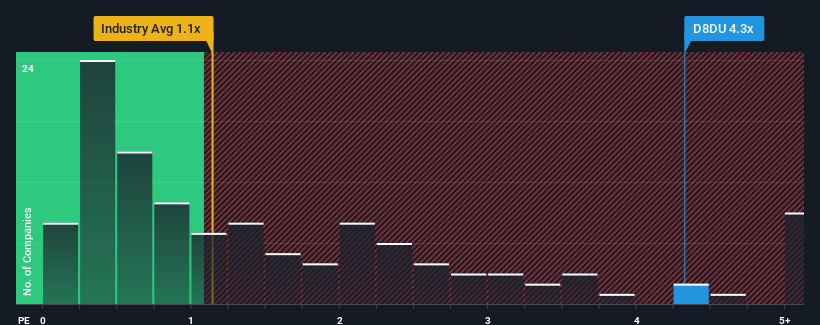

In spite of the heavy fall in price, when almost half of the companies in Singapore's Shipping industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider First Ship Lease Trust as a stock not worth researching with its 4.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

儘管價格大幅下跌,但當新加坡航運業中將近一半的公司的市售比率(或 “P/S”)低於1.9倍時,您仍然可以將First Ship Lease Trust視爲不值得研究的股票,其市盈率爲4.3倍。但是,市盈率可能很高是有原因的,需要進一步調查才能確定是否合理。

See our latest analysis for First Ship Lease Trust

查看我們對第一艘船租賃信託的最新分析

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023

新加坡證券交易所:D8DU 市銷比率與行業對比 2023 年 10 月 22 日

What Does First Ship Lease Trust's P/S Mean For Shareholders?

First Ship Lease Trust的市盈率對股東意味着什麼?

For example, consider that First Ship Lease Trust's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

例如,考慮一下,由於收入下降,First Ship Lease Trust最近的財務表現一直很差。也許市場認爲,該公司可以做得足夠多,在不久的將來跑贏該行業的其他公司,這使市盈率保持在較高的水平。如果不是,那麼現有股東可能會對股價的可行性感到非常緊張。

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on First Ship Lease Trust will help you shine a light on its historical performance.

想全面了解公司的收益、收入和現金流嗎?然後我們的 免費的 關於First Ship Lease Trust的報告將幫助你了解其歷史表現。

Is There Enough Revenue Growth Forecasted For First Ship Lease Trust?

預計第一艘船租賃信託的收入增長是否足夠?

The only time you'd be truly comfortable seeing a P/S as steep as First Ship Lease Trust's is when the company's growth is on track to outshine the industry decidedly.

你唯一能真正放心地看到像First Ship Lease Trust這樣高漲的市盈率的時候,是該公司的增長有望絕對超越整個行業。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. This means it has also seen a slide in revenue over the longer-term as revenue is down 79% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

首先回顧一下,該公司去年的收入增長並不令人興奮,因爲它公佈了令人失望的42%的下降。這意味着從長遠來看,它的收入也有所下滑,因爲在過去三年中,總收入下降了79%。因此,股東們會對中期收入增長率感到悲觀。

Comparing that to the industry, which is predicted to shrink 17% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

與該行業相比,該行業預計將在未來12個月內萎縮17%,根據最近的中期年化收入業績,該公司的下行勢頭仍然不佳。

In light of this, it's odd that First Ship Lease Trust's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

有鑑於此,奇怪的是,First Ship Lease Trust的市盈率高於大多數其他公司。由於收入迅速逆轉,還不能保證市盈率會達到下限。如果該公司不改善收入增長,市盈率有可能降至較低水平,而當前的行業前景很難做到這一點。

The Bottom Line On First Ship Lease Trust's P/S

First Ship Lease Trust P/S 的底線

First Ship Lease Trust's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

First Ship Lease Trust的股票可能遭受了損失,但其市盈率仍然很高。通常,在確定投資決策時,我們謹慎行事,不要過多地閱讀市售比率,儘管這可以充分揭示其他市場參與者對公司的看法。

Our examination of First Ship Lease Trust revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我們對First Ship Lease Trust的調查顯示,鑑於該行業的萎縮幅度將不那麼嚴重,其三年收入急劇萎縮對其高市盈率的影響並沒有我們預期的那麼大。目前,我們對高市盈率並不滿意,因爲這種收入表現不太可能長期支持這種積極的情緒。此外,我們擔心在這些艱難的行業條件下,該公司能否維持其中期業績水平。這將使股東的投資面臨重大風險,潛在投資者面臨支付過高溢價的危險。

We don't want to rain on the parade too much, but we did also find 2 warning signs for First Ship Lease Trust that you need to be mindful of.

我們不想在遊行隊伍中下太多雨,但我們也發現了 第一船租賃信託基金的 2 個警告標誌 這是你需要注意的。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果實力雄厚的公司讓你大開眼界,那麼你一定要看看這個 免費的 以低市盈率交易(但已證明可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 請直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023

SGX:D8DU Price to Sales Ratio vs Industry October 22nd 2023