One of the frustrations of investing is when a stock goes down. But no-one can make money on every call, especially in a declining market. While the Zhejiang Yankon Group Co., Ltd. (SHSE:600261) share price is down 19% in the last three years, the total return to shareholders (which includes dividends) was -4.6%. And that total return actually beats the market decline of 11%. The falls have accelerated recently, with the share price down 14% in the last three months. Of course, this share price action may well have been influenced by the 8.8% decline in the broader market, throughout the period.

Since Zhejiang Yankon Group has shed CN¥481m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Zhejiang Yankon Group

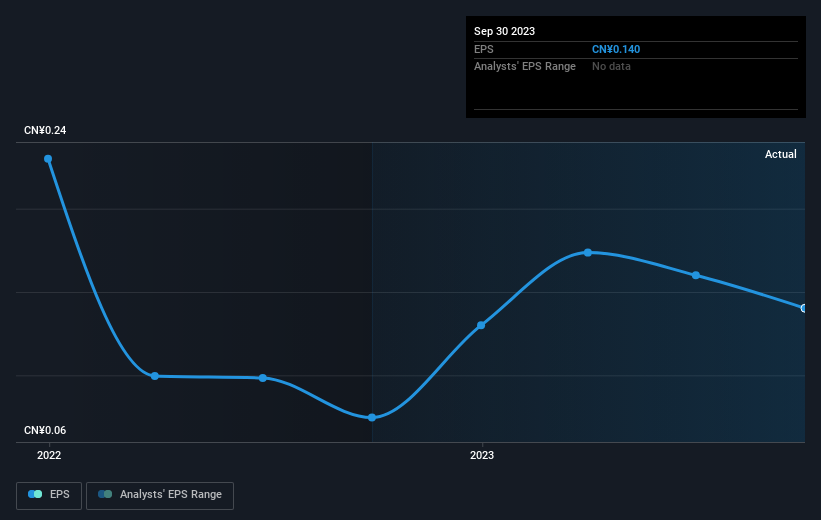

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Zhejiang Yankon Group saw its EPS decline at a compound rate of 21% per year, over the last three years. This fall in the EPS is worse than the 7% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Zhejiang Yankon Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Zhejiang Yankon Group's TSR for the last 3 years was -4.6%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Zhejiang Yankon Group shareholders have received a total shareholder return of 4.4% over one year. That's including the dividend. However, the TSR over five years, coming in at 7% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It's always interesting to track share price performance over the longer term. But to understand Zhejiang Yankon Group better, we need to consider many other factors. For example, we've discovered 3 warning signs for Zhejiang Yankon Group (1 is potentially serious!) that you should be aware of before investing here.

We will like Zhejiang Yankon Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.