It can certainly be frustrating when a stock does not perform as hoped. But it can difficult to make money in a declining market. The Shanghai Feilo Acoustics Co.,Ltd (SHSE:600651) share price is down 11% in the last three years. The silver lining to that cloud is that this return is superior to the average market decline of 11%. The share price has dropped 17% in three months. But this could be related to the weak market, which is down 8.8% in the same period.

Since Shanghai Feilo AcousticsLtd has shed CN¥652m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Shanghai Feilo AcousticsLtd

We don't think that Shanghai Feilo AcousticsLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

We don't think that Shanghai Feilo AcousticsLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years Shanghai Feilo AcousticsLtd saw its revenue shrink by 12% per year. That's not what investors generally want to see. The stock is down just 4% per year over three years, which isn't too bad. The weak broader market would have contributed to the lack of optimism. But ultimately, given the weak revenue, we'd like to see evidence of imminent profits before we can muster much enthusiasm for this one.

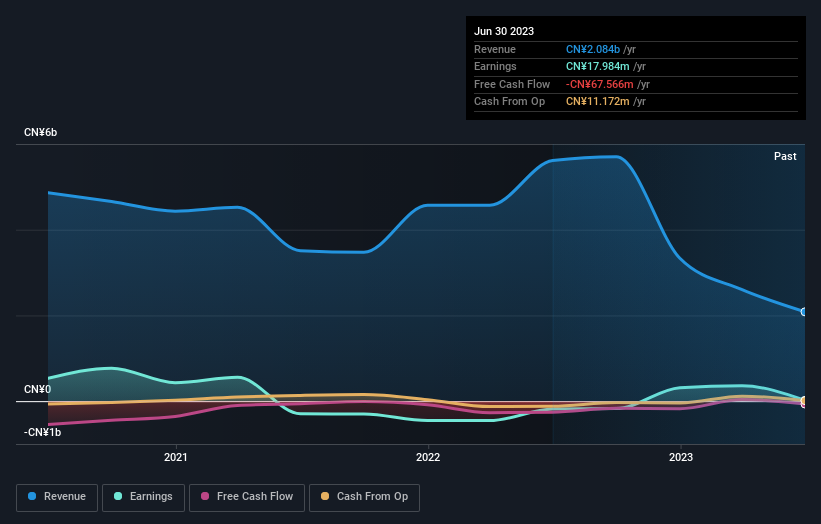

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While it's certainly disappointing to see that Shanghai Feilo AcousticsLtd shares lost 1.5% throughout the year, that wasn't as bad as the market loss of 6.5%. Given the total loss of 0.1% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Shanghai Feilo AcousticsLtd , and understanding them should be part of your investment process.

We will like Shanghai Feilo AcousticsLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.