Sincere Watch (Hong Kong) Limited (HKG:444) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

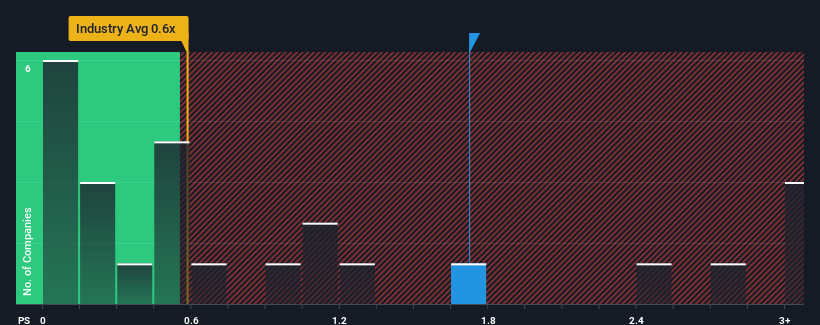

Even after such a large drop in price, you could still be forgiven for thinking Sincere Watch (Hong Kong) is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in Hong Kong's Retail Distributors industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Sincere Watch (Hong Kong)

How Has Sincere Watch (Hong Kong) Performed Recently?

For example, consider that Sincere Watch (Hong Kong)'s financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sincere Watch (Hong Kong)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Sincere Watch (Hong Kong)'s P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. The last three years don't look nice either as the company has shrunk revenue by 62% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 20% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Sincere Watch (Hong Kong)'s P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Sincere Watch (Hong Kong)'s P/S?

Sincere Watch (Hong Kong)'s P/S remain high even after its stock plunged. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Sincere Watch (Hong Kong) currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Sincere Watch (Hong Kong) (2 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.