Shanghai Lonyer Data Co., Ltd. (SHSE:603003) shares have had a really impressive month, gaining 36% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 58%.

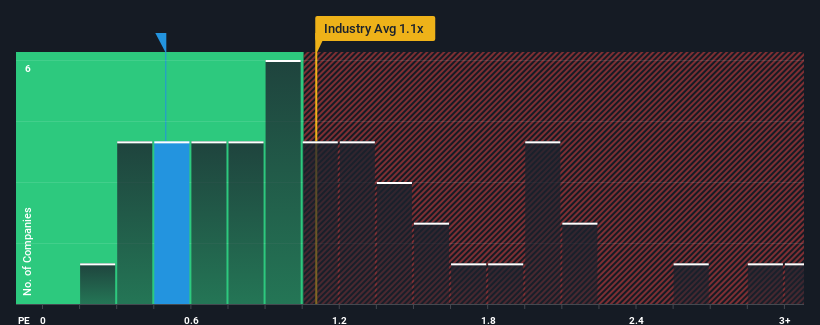

Although its price has surged higher, when close to half the companies operating in China's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Shanghai Lonyer Data as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shanghai Lonyer Data

How Has Shanghai Lonyer Data Performed Recently?

For example, consider that Shanghai Lonyer Data's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Shanghai Lonyer Data will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

For example, consider that Shanghai Lonyer Data's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Shanghai Lonyer Data will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Is There Any Revenue Growth Forecasted For Shanghai Lonyer Data?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shanghai Lonyer Data's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 4.5% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 31% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 0.3% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this information, it's not too hard to see why Shanghai Lonyer Data is trading at a lower P/S in comparison. Nonetheless, with revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Shanghai Lonyer Data's P/S

Shanghai Lonyer Data's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Shanghai Lonyer Data confirms that the company's severe contraction in revenue over the past three-year years is a major contributor to its lower than industry P/S, given the industry is set to decline less. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shanghai Lonyer Data with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.