Lacklustre Performance Is Driving Hubei Kailong Chemical Group Co., Ltd.'s (SZSE:002783) Low P/S

Lacklustre Performance Is Driving Hubei Kailong Chemical Group Co., Ltd.'s (SZSE:002783) Low P/S

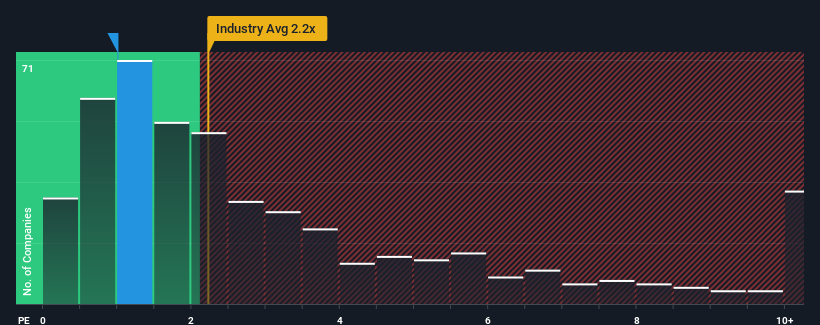

With a price-to-sales (or "P/S") ratio of 1x Hubei Kailong Chemical Group Co., Ltd. (SZSE:002783) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in China have P/S ratios greater than 2.2x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

以1倍的价格销售比(或“P/S”)湖北凯龙化工集团有限公司。深交所(SZSE:002783)目前可能正在发出看涨信号,因为中国几乎一半的化工公司的市盈率高于S的2.2倍,即使市盈率高于S的5倍也并不罕见。然而,P/S可能是有原因的,需要进一步调查才能确定是否合理。

View our latest analysis for Hubei Kailong Chemical Group

查看我们对湖北凯龙化工集团的最新分析

What Does Hubei Kailong Chemical Group's P/S Mean For Shareholders?

湖北凯龙化工集团P/S对股东意味着什么?

Revenue has risen firmly for Hubei Kailong Chemical Group recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

湖北凯龙化工集团最近收入稳步增长,这是令人欣慰的。或许市场预期这一可接受的营收表现将大幅跳水,这令市盈率/S受到压制。如果这一点没有实现,那么现有股东有理由对未来股价的走势持乐观态度。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

收入增长指标告诉我们关于低市盈率的哪些信息?

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.

为了证明其市盈率与S的比率是合理的,湖北凯龙化工集团需要实现落后于行业的低迷增长。

If we review the last year of revenue growth, the company posted a worthy increase of 12%. Pleasingly, revenue has also lifted 107% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

如果我们回顾去年的收入增长,该公司公布了12%的合理增长。令人欣喜的是,营收也较三年前增长了107%,这在一定程度上要归功于过去12个月的增长。因此,公平地说,最近的收入增长对公司来说是一流的。

This is in contrast to the rest of the industry, which is expected to grow by 31% over the next year, materially higher than the company's recent medium-term annualised growth rates.

这与其他行业形成鲜明对比,预计明年该行业将增长31%,大大高于该公司最近的中期年化增长率。

With this in consideration, it's easy to understand why Hubei Kailong Chemical Group's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

考虑到这一点,就不难理解为什么湖北凯龙化工集团的P/S没有达到行业同行的标准。显然,许多股东对持有他们认为将继续落后于整个行业的股票感到不舒服。

The Final Word

最后的结论

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

一般来说,我们倾向于将市销率的使用限制在确定市场对公司整体健康状况的看法上。

As we suspected, our examination of Hubei Kailong Chemical Group revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

正如我们怀疑的那样,我们对湖北凯龙化工集团的调查显示,该集团三年的营收趋势是导致其低市盈率的原因之一,因为它们看起来比当前行业预期的要差。目前,股东们正在接受S的低市盈率,因为他们承认,未来的收入可能不会带来任何令人愉快的惊喜。如果近期的中期营收趋势持续下去,很难看到该公司股价在短期内出现逆转。

It is also worth noting that we have found 4 warning signs for Hubei Kailong Chemical Group (2 make us uncomfortable!) that you need to take into consideration.

同样值得注意的是,我们发现湖北凯龙化工集团的4个警示标志(2让我们感到不舒服!)这是你需要考虑的。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

当然了,利润丰厚、盈利增长迅速的公司通常是更安全的押注。所以你可能想看看这个免费其他市盈率合理、盈利增长强劲的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Hubei Kailong Chemical Group would need to produce sluggish growth that's trailing the industry.