AI概念が「深海」に到達し、海外のテクノロジー巨大企業もビジネスモデルの問題に直面しており、国内でこの方向に賭ける企業間の差も徐々に明らかになっています。

三季報によると、A株「AIコンセプト株」企業の業績は引き続き分化傾向を示しており、コンピューター能力の龍頭企業中科曙光は安定した収益を維持し、大型モデルの龍頭昆仑万維は黒字から赤字に転落し、IP AIインタラクションを主力とするトムキャット社の業績は「足首切断」となっています。

中科曙光:純利益は前年同期比20%増加しました。

信創+AIのリーダーである中科曙光は、第3四半期の売上高はわずかに減少しましたが、純利益は安定した成長を維持しています。

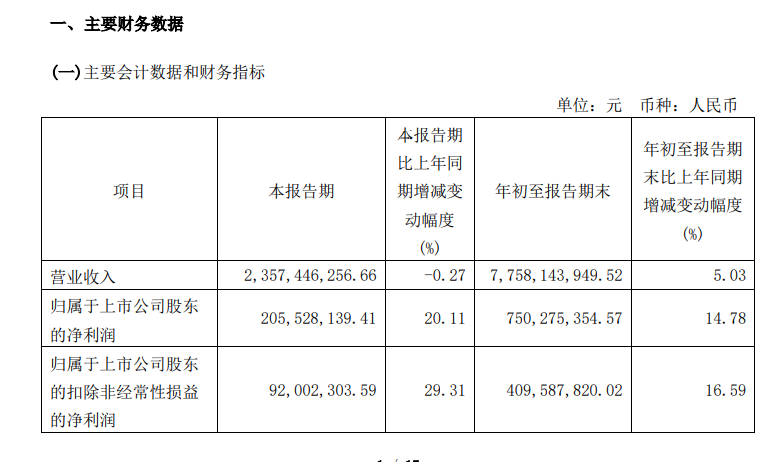

今年の第三四半期、中科曙光は23.57億元の売上高を実現し、前年同期比で0.27%減少し、上場企業株主に帰属する純利益は20.11%増の20.6億元であり、非課税の巣の利益が9200万元で、前年同期比で29.31%増加しました。

今年の第三四半期、中科曙光は23.57億元の売上高を実現し、前年同期比で0.27%減少し、上場企業株主に帰属する純利益は20.11%増の20.6億元であり、非課税の巣の利益が9200万元で、前年同期比で29.31%増加しました。

前三四半期、中科曙光の営業収入は77.58億元に達し、前年同期比で5.03%増となり、親会社の純利益は7.5億元に達し、前年同期比で14.78%増となり、そこから非公認の親会社の純利益は4.10億元に達し、前年同期比で16.59%増となった。

国海証券は、中科曙光が信創のリズム変化やAIチップのサプライチェーンの緊張などの不利な要因に直面しながらも、安定した業績成長を実現したことが、その中核的な競争力の強化、技術力の向上、および自主コントロールの強化を反映していると考えています。

中科曙光は、中国科学院計算技術研究所を実質支配者とし、我が国の中核情報基盤分野のリード企業であり、高度計算、ストレージ、セキュリティ、データセンター等の関連製品の研究開発及び製造に従事し、積極的な知的計算、ビッグデータ、クラウド・コンピューティング等ビジネスを展開し、「芯ー端ークラウド」一体化された全産業連鎖を完備しています。同社の液冷データセンター基盤市場シェアは、多年にわたって国内業界の第1を維持しています。それに加え、全国で50以上のクラウド・コンピューティングセンターを建設し、国内最大規模の算力サービスネットワークを所有しています。

現在までに、中科曙光は「悟道2.0」「紫東太初」「文心一言」「通義千問」など多数の大規模モデルのトレーニング、ファインチューニング、推論などに参加し、GPTシリーズ、LLaMAシリーズ、GLMシリーズなど30以上の国内外の主要な大規模モデルの適応孵化を完了しました。また、企業は大規模モデル一体型マシン、大規模モデルストレージソリューションなどを開発し、リーディングエッジの水没型相変液冷技術と冷板式冷却技術を研究し、国内の水冷データセンター市場シェアを58%以上に引き上げました。

コンゴウマンユイ:第三四半期の損失は2983万円

昆仑万维は第3四半期の業績が持続的に低迷し、黒字から赤字に転落しました。

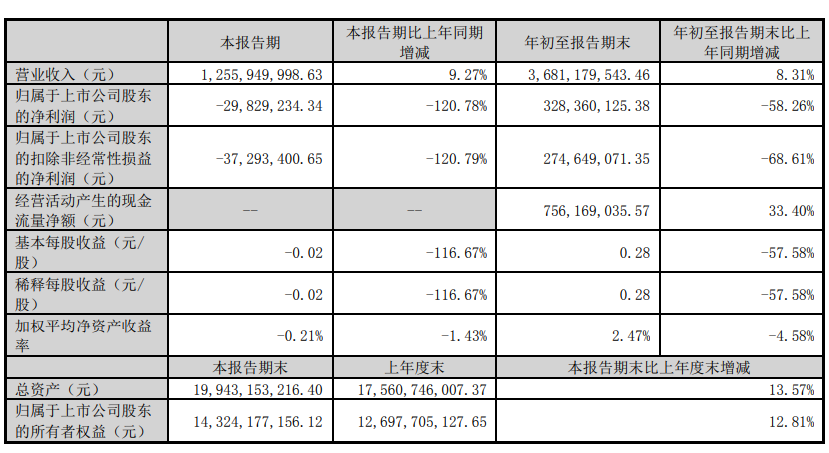

三四半期、コンロンワンウェイの売上高は12.56億元で、前年同期比9.27%増、純損失は2982.92万元で、前年同期比120.78%下落し、黒字から赤字に転化した。非再生処理後の損失は3729.34万元、前年同期比120.79%下落し、1株当たりの純損失は0.02元です。

前三四半期、クンルン万緯は営業収入が36.81億元で、前年同期比で8.31%増加し、純利益が3.28元で、前年同期比で58.26%減少し、調整後純利益が27.5億元で、前年同期比で68.61%減少しています。

コンロン万維は、今年の第1四半期から第3四半期まで、同社の海外事業収入の割合が84%にまで増加し、前年比で約9ポイント増加した。全体的なグロスマージンは80%で、高い水準を維持しています。

昆仑万维は財務諸表において「天工」の大型モデルが論理推論力、テキスト理解力、マルチモーダル能力など多岐にわたる領域で大きく突破したと報告しました。また、「天工」アプリケーションはAI検索、AI読書、AI創作などのコア機能を統合した全面的なアップグレードを行い、仕事、学習、生活など多数のアプリケーションシーンをカバーしています。

AI・ゲーム分野、同社傘下のPlay for Funゲームスタジオが自社開発した初のAIゲーム『Club Koala』が8月25日にドイツ・ケルン国際ゲーム展で展示された。同ゲームに搭載されたUGCゲームエディター『Koala Editor』は、ユーザーがコードレスでゲーム開発を行うことを支援し、ゲームの創作の敷居を大幅に下げる。

算力について、本四半期末までに、昆仑万维は以前からのチップの購入とリースが約6000枚到着し、さらに約3000枚のチップが納品待ちです。現在、同社は映像AIGCを除く将来の1〜2年の大型モデルの算力要件を満たすと予想される算力を持っています。

また、人工知能競技場での長期的な中核的競争優位を確立および維持するため、クンルン万維は、AI計算力チップ企業の北京艾捷科芯科技有限公司(以下、"艾捷科芯"とする)の株式を増資することで、"計算力基盤-大規模モデルアルゴリズム-AIアプリケーション"の全産業チェーンレイアウトを完成しました。アイジェコックスは、プログラム可能かつ高性能のNPU製品を開発し、モデルトレーニングおよび推論用にそれを適用することを目的としています。

トムキャット: 純利益が87.53%減少し、社会保障基金が流通株式の上位10位に入る

グローバルなマクロ経済の弱さ、新製品がない期間などの影響を受けて、トムキャットの第三四半期の業績は持続的に不振であり、非GAAP営利益は「脚首を斬る」。

今年の第三四半期に、トムキャットの売上高は3.4億元で、前年同期比16.53%減少し、上場会社の株主に帰属する純利益は1364万元で、前年同期比87.53%減少しました。調整後の純利益はわずか865万元で、前年同期比91.90%減少しました。

前の3四半期、トムキャットの営業収入は102.8億元で、前年同期比で18.38%下落し、株主の純利益は20億元に減少し、前年同期比でほぼ半分になり、1.89億元の非一次的な純利益は、前期比で50%以上減少しました。

業績大幅低下の原因について、トムキャットは報告書で、同社のトムキャットファミリーIPシリーズ製品がグローバル市場で持続的に活況を呈し、MAU(毎月アクティブユーザー数)、DAU(毎日アクティブユーザー数)などの製品データは安定しているが、グローバルマクロ経済の低迷、期間中に新製品が立ち上がらなかったなどの要因によって、会社全体の収益が減少したと説明しています。また、報告期間中に、新製品開発投資を引き続き拡大し、開発支出と関連費用が増加しました。さらに、会社はスロベニアでの法人税が増加しました。これらの理由により、会社の当期利益が減少しました。

AI製品の分野では、トムキャットは、会社内外の研究開発チームが3つのAIアプリケーション製品を開発およびテストしていると述べました。その中で、国内の研究開発チームと西湖心辰との共同作業によって開発された多機能のAIトムキャット製品による多機能を初めとして、写真認識、英文スピーキング初心者向け、興味導入、科学啓蒙教育、AI生画像、AI生成絵本、状況対話などが実現されています。会社の海外チームが開発した初のAIゲーム「Talking Ben AI」は、2023年8月28日にスロバキア、キプロス、南アフリカなどで最初の海外テストが開始されました。会社の国内チームが開発したトムキャットストーリーテリングAI製品は、2023年第4四半期に最初のテストが開始される予定です。

また、トムキャットの財務報告書によると、第3四半期に社会保障基金414グループが上位10位に入り、810.0万株を保有し、流通株式比率は0.26%です。

今年第三季度,中科曙光实现营业收入23.57亿元,同比下滑0.27%,归属于上市公司股东的净利润为2.06亿元,同比增长20.11%,扣非归母经利润9200万元,同比增长29.31%。

今年第三季度,中科曙光实现营业收入23.57亿元,同比下滑0.27%,归属于上市公司股东的净利润为2.06亿元,同比增长20.11%,扣非归母经利润9200万元,同比增长29.31%。