Sinoma Science & Technology Co.,Ltd. (SZSE:002080) shareholders are probably feeling a little disappointed, since its shares fell 9.4% to CN¥16.81 in the week after its latest quarterly results. Statutory earnings per share fell badly short of expectations, coming in at CN¥0.19, some 37% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at CN¥5.9b. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Sinoma Science & TechnologyLtd

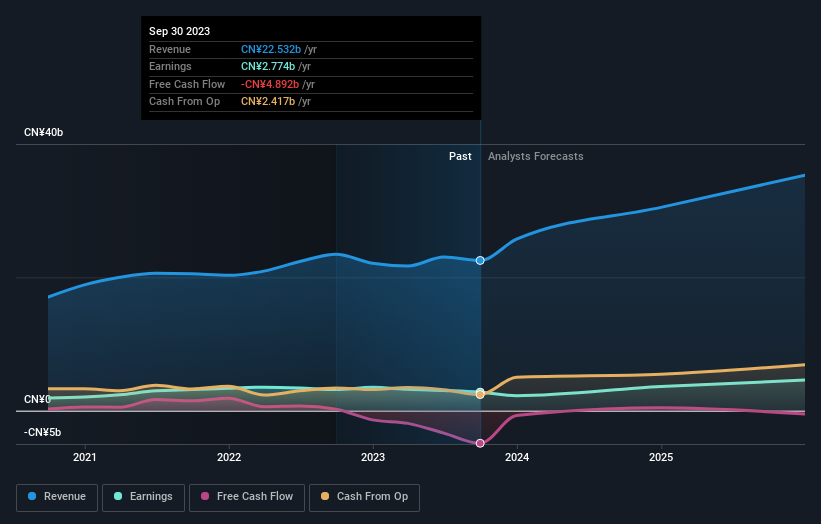

After the latest results, the ten analysts covering Sinoma Science & TechnologyLtd are now predicting revenues of CN¥30.5b in 2024. If met, this would reflect a major 35% improvement in revenue compared to the last 12 months. Per-share earnings are expected to bounce 31% to CN¥2.16. In the lead-up to this report, the analysts had been modelling revenues of CN¥31.0b and earnings per share (EPS) of CN¥2.48 in 2024. The analysts seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a substantial drop in EPS estimates.

The consensus price target held steady at CN¥27.81, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Sinoma Science & TechnologyLtd at CN¥34.24 per share, while the most bearish prices it at CN¥21.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

The consensus price target held steady at CN¥27.81, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Sinoma Science & TechnologyLtd at CN¥34.24 per share, while the most bearish prices it at CN¥21.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Sinoma Science & TechnologyLtd's rate of growth is expected to accelerate meaningfully, with the forecast 27% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 15% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 19% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Sinoma Science & TechnologyLtd is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Sinoma Science & TechnologyLtd going out to 2025, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 3 warning signs for Sinoma Science & TechnologyLtd (2 shouldn't be ignored!) that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.