Following the purchase of ETFs by foreign investors and foreign exchange funds, since October, more and more private equity firms have been using ETFs to increase the layout of equity assets.

A number of private equity funds appear in the list of the top ten equity ETF holders.According to the Cathay Pacific China Securities Full Index integrated circuit ETF listing transaction announcement, Zixin Mingxin No. 1 private equity investment fund holds 3 million shares of the ETF; the Huaxia China Securities semiconductor materials and equipment theme ETF listing transaction announcement shows that products owned by managers such as Beijing Zhongxin Rongda Investment, Fujian Jinjiang, Fujian, China Binary Assets, Hainan Jingge Private Equity, and Hangzhou Yichen Private Equity also appeared on the list of the top ten holders of the ETF; 5 private investors also appeared on the list of the top ten holders of the Huitianfu China Securities dividend ETF. It also includes Lingding Investment in Ningbo Meishan Bonded Port Area Billion-level private placement.

Since this year, the overall ETF market has shown the characteristics of “the more you fall, the more you buy”.Affected by market sentiment in the past two months, there was a rare decline in scale. This week ushered in a reversal. In the four trading days from October 23 to October 26, stock ETFs had a cumulative net inflow of 16.304 billion yuan, reversing the net outflow from the previous period of this month.

ETFs that track the Shanghai and Shenzhen 300 Index on the market have increased in size by more than 28 billion yuan since the second half of the year. At the same time, although the index showed adjustments, as reflected in the Shanghai and Shenzhen 300 related ETFs, capital showed the characteristic of “buying more as it falls.” By October, the inflow of capital into Shanghai and Shenzhen 300 had clearly slowed down. Before October 23, the shares of all Shanghai and Shenzhen 300 ETFs increased by only about 500 million shares in that month, but on October 23, the share growth reached nearly 1.5 billion shares.

ETFs that track the Shanghai and Shenzhen 300 Index on the market have increased in size by more than 28 billion yuan since the second half of the year. At the same time, although the index showed adjustments, as reflected in the Shanghai and Shenzhen 300 related ETFs, capital showed the characteristic of “buying more as it falls.” By October, the inflow of capital into Shanghai and Shenzhen 300 had clearly slowed down. Before October 23, the shares of all Shanghai and Shenzhen 300 ETFs increased by only about 500 million shares in that month, but on October 23, the share growth reached nearly 1.5 billion shares.

On October 23, after Central Huijin announced “buying a tradable open-ended index fund ETF and indicating that it will continue to increase its holdings in the future,” many ETFs received capital inflows, and the market welcomed an additional amount of capital.

The market has been cold this year, and ETFs have completely exploded.

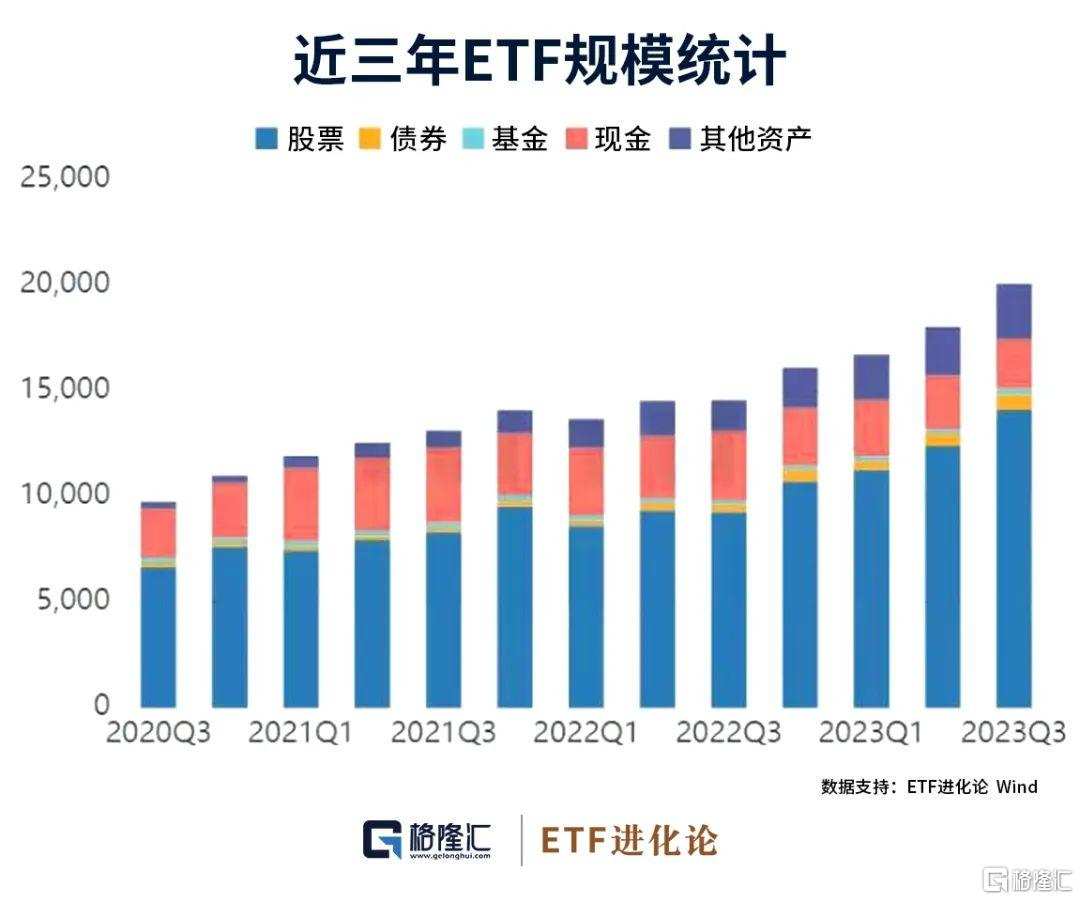

As of the third quarter of this year, the ETF market reached a new high of 1.9 trillion yuan, an increase of 11.49% over the previous quarter. Among them, equity ETFs continued to increase, reaching 1.41 trillion yuan in size, an increase of 13.71% over the previous month.

Over the past three years, the size of ETFs has grown by more than 100%.

Looking at the world, this trend is even more obvious。 There are institutions that have experienced historical retrading. After every crisis in the past, the ETF market has made a qualitative leap forward. After the internet bubble in 2000, the subprime mortgage crisis in 2008, and the COVID-19 US stock crisis in 2020, a large amount of incremental capital flowed into ETFs.

Since the birth of the capital market, the stock market has generally followed human development and has risen, but because of the expansion of the stock market, there are more and more listed companies, investors will inevitably face choices if they want to share the development of the times. Buying individual stocks poses a risk of stealing thunder, making it difficult to achieve real long-term allocation.

As the market matures, it becomes more and more difficult for investors to beat the index.

Probably many people think this is unbelievable. Buffett made a gamble for this, which directly convinced the famous American hedge fund. Buffett believes that from a 10-year perspective, active fund managers outperform the S&P 500 in earnings. After proposing a gamble, out of thousands of investment managers, only Ted Siders came forward to fight. He chose 5 fund portfolios covering 200 hedge funds.

Ten years later, the passive fund selected by Buffett had an actual compound annual yield of 7.1%, and the five active funds selected by Ted had a compound annual yield of 2.2%. Buffett said that for ordinary investors, buying ETFs is the best choice, and few people can beat the index for a long time. It is undeniable that index funds are being chosen by more and more people, and even professional institutions are increasingly choosing ETFs to participate in the market. The world's leading hedge funds can always see ETFs in their holdings when disclosing their holdings. There are even some countries' central banks that go directly off the market and buy ETFs.

Beginning in 2010, the Bank of Japan personally exited the market to achieve the goal of stimulating the economy through the purchase of ETFs. As of March 2023, the Bank of Japan disclosed that the total market value of currently held ETFs is as high as 53 trillion yen (approximately $370 billion), which is equivalent to RMB 2.6 trillion based on an exchange rate of 1 to 7, exceeding the total market value of all A-share ETFs at the time.