ICON Public Limited Company (NASDAQ:ICLR) Just Released Its Third-Quarter Results And Analysts Are Updating Their Estimates

ICON Public Limited Company (NASDAQ:ICLR) Just Released Its Third-Quarter Results And Analysts Are Updating Their Estimates

It's been a good week for ICON Public Limited Company (NASDAQ:ICLR) shareholders, because the company has just released its latest third-quarter results, and the shares gained 3.8% to US$235. ICON reported in line with analyst predictions, delivering revenues of US$2.1b and statutory earnings per share of US$1.97, suggesting the business is executing well and in line with its plan. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

对于ICON公共有限公司(纳斯达克股票代码:ICLR)的股东来说,这是美好的一周,因为该公司刚刚发布了最新的第三季度业绩,股价上涨了3.8%,至235美元。ICON报告与分析师的预测一致,收入为21亿美元,法定每股收益为1.97美元,这表明该业务表现良好,符合其计划。分析师通常会在每份收益报告中更新他们的预测,我们可以从他们的估计中判断他们对公司的看法是否发生了变化,或者是否有任何新的问题需要注意。根据这些结果,我们收集了最新的法定预测,以了解分析师是否改变了盈利模式。

Check out our latest analysis for ICON

查看我们对 ICON 的最新分析

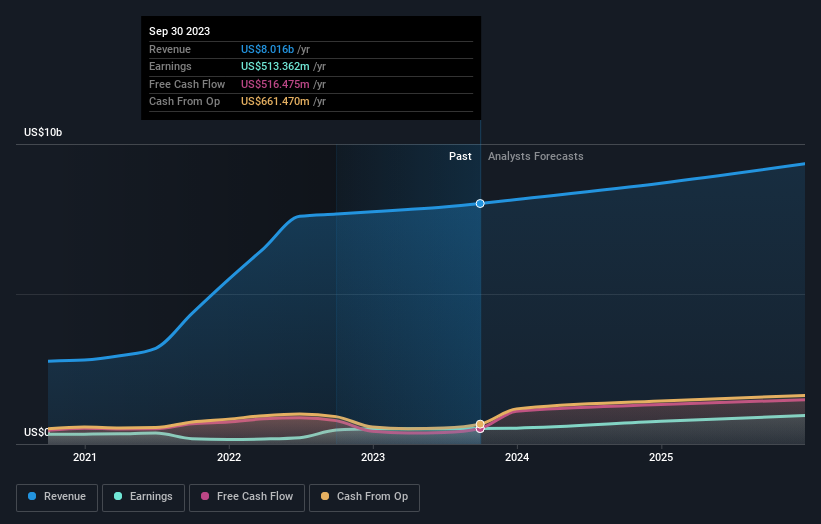

Taking into account the latest results, the current consensus from ICON's 13 analysts is for revenues of US$8.69b in 2024. This would reflect a meaningful 8.5% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to surge 48% to US$9.25. In the lead-up to this report, the analysts had been modelling revenues of US$8.68b and earnings per share (EPS) of US$9.61 in 2024. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

考虑到最新业绩,ICON的13位分析师目前的共识是,2024年的收入为86.9亿美元。这将反映其收入在过去12个月中大幅增长8.5%。预计每股法定收益将激增48%,至9.25美元。在本报告发布之前,分析师一直在模拟2024年的收入为86.8亿美元,每股收益(EPS)为9.61美元。因此,在最近的业绩公布之后,整体情绪似乎略有下降——收入估计没有重大变化,但分析师的每股收益预测确实略有下降。

It might be a surprise to learn that the consensus price target was broadly unchanged at US$282, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on ICON, with the most bullish analyst valuing it at US$306 and the most bearish at US$220 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

得知共识目标股价基本保持不变,为282美元,这可能会令人惊讶,分析师明确表示,预期的收益下降预计不会对估值产生太大影响。但是,这并不是我们可以从这些数据中得出的唯一结论,因为一些投资者在评估分析师目标股价时也喜欢考虑估计值的差异。对ICON的看法有所不同,最看涨的分析师将其估值为306美元,最看跌的为每股220美元。对该股肯定有一些不同的看法,但在我们看来,估计范围还不够广,不足以暗示情况不可预测。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that ICON's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 6.7% growth on an annualised basis. This is compared to a historical growth rate of 30% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.1% per year. Even after the forecast slowdown in growth, it seems obvious that ICON is also expected to grow faster than the wider industry.

了解这些预测的更多背景信息的一种方法是研究它们与过去的业绩相比如何,以及同一行业中其他公司的表现。很明显,预计ICON的收入增长将大幅放缓,预计到2024年底的收入按年计算将增长6.7%。相比之下,过去五年的历史增长率为30%。将其与业内其他有分析师报道的公司并列,预计这些公司的收入(总计)每年将增长4.1%。即使在预测增长放缓之后,似乎很明显,预计ICON的增长速度也将超过整个行业。

The Bottom Line

底线

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for ICON. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

最大的担忧是,分析师下调了每股收益预期,这表明ICON可能会面临业务不利因素。幸运的是,他们还再次确认了收入数字,表明收入符合预期。此外,我们的数据表明,收入的增长速度预计将快于整个行业。共识目标股价没有实际变化,这表明该业务的内在价值与最新估计相比没有发生任何重大变化。

With that in mind, we wouldn't be too quick to come to a conclusion on ICON. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for ICON going out to 2025, and you can see them free on our platform here..

考虑到这一点,我们不会很快就ICON得出结论。长期盈利能力比明年的利润重要得多。在Simply Wall St,我们有分析师对2025年之前ICON的全方位估计,你可以在我们的平台上免费看到这些估计。

And what about risks? Every company has them, and we've spotted 1 warning sign for ICON you should know about.

那风险呢?每家公司都有它们,我们发现了 1 个你应该知道的 ICON 警告标志。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

It might be a surprise to learn that the consensus price target was broadly unchanged at US$282, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on ICON, with the most bullish analyst valuing it at US$306 and the most bearish at US$220 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

It might be a surprise to learn that the consensus price target was broadly unchanged at US$282, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on ICON, with the most bullish analyst valuing it at US$306 and the most bearish at US$220 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.