10月PMI数据将公布;美联储将公布利率决议;央行公开市场将有28240亿元逆回购到期;逾1230亿元市值限售股解禁。

【重磅新闻】

10月PMI数据将公布

10月31日,国家统计局将公布10月PMI数据。9月份,制造业采购经理指数(PMI)为50.2%,比上月上升0.5个百分点,重返扩张区间。

10月31日,国家统计局将公布10月PMI数据。9月份,制造业采购经理指数(PMI)为50.2%,比上月上升0.5个百分点,重返扩张区间。

华创证券研究所副所长、首席宏观分析师张瑜预计,未来工业生产增长保持平稳,10月制造业PMI或能继续回升。一方面,国庆文旅消费继续恢复,有望带动餐饮、线下消费以及相关行业生产的回升。另一方面,在促销带动下,汽车零售稳中有升。此外,美国零售回暖,出口或有所上行。

美联储将公布利率决议

11月2日,美联储将公布利率决议。美联储11月维持利率在5.25%-5.50%区间不变的概率为97.5%,加息25个基点至5.50%-5.75%区间的概率为2.5%。到12月维持利率不变的概率为76.0%,累计加息25个基点概率为23.4%,累计加息50个基点概率为0.5%。

央行公开市场将有28240亿元逆回购到期

Wind数据显示,下周(10月30日至11月3日)央行公开市场将有28240亿元逆回购到期,其中,周一至周五分别到期8080亿元、5930亿元、5000亿元、4240亿元、4990亿元。

逾1230亿元市值限售股解禁

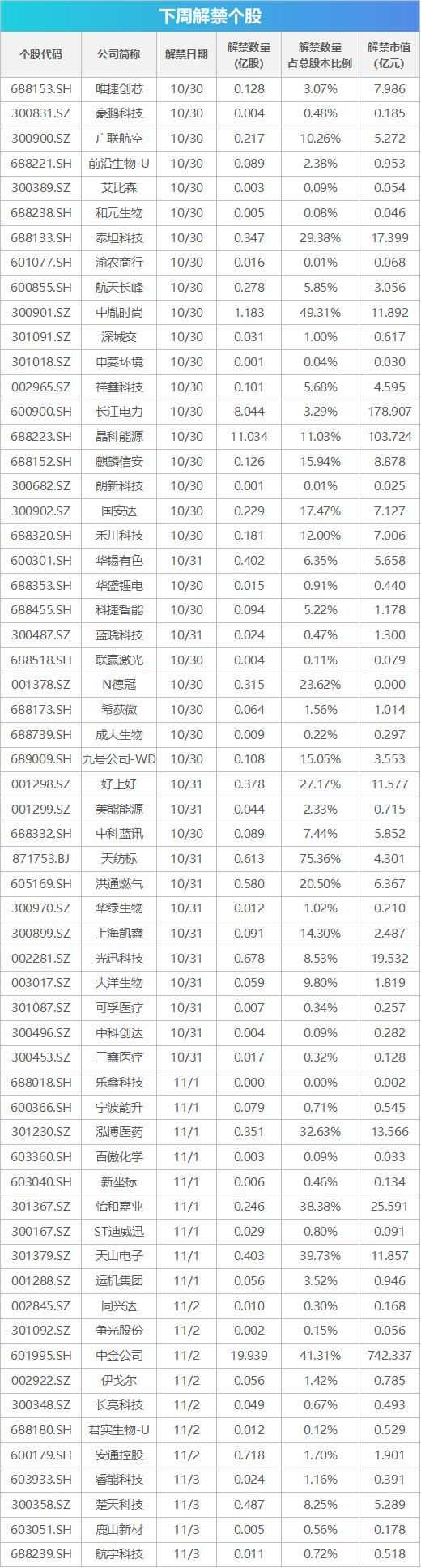

Wind数据显示,下周(10月30日-11月3日)共有60家公司限售股陆续解禁,合计解禁48.11亿股,按10月27日收盘价计算,解禁总市值为1230.27亿元。

从解禁市值来看,11月2日是解禁高峰期,7家公司解禁市值合计746.27亿元,占下周解禁规模的60.6%。按10月27日收盘价计算,解禁市值居前三位的是:中金公司(742.34亿元)、长江电力(178.91亿元)、晶科能源(103.72亿元)。从个股的解禁量看,解禁股数居前三位的是:中金公司(19.94亿股)、晶科能源(11.03亿股)、长江电力(8.04亿股)。

【新股机会】

下周,A股将有3只新股网上发行。其中10月30日发行的是联域股份、美心翼申;11月2日发行的是中邮科技。