The Total Return for Tempur Sealy International (NYSE:TPX) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

The Total Return for Tempur Sealy International (NYSE:TPX) Investors Has Risen Faster Than Earnings Growth Over the Last Five Years

Tempur Sealy International, Inc. (NYSE:TPX) shareholders might be concerned after seeing the share price drop 14% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 211% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Only time will tell if there is still too much optimism currently reflected in the share price.

坦普爾海利國際公司(紐約證券交易所股票代碼:TPX)的股東在看到股價在上個季度下跌了14%後可能會感到擔憂。但這幾乎不會減損該公司在五年內產生的真正穩健的長期回報。我們認為,大多數投資者會對這段時間211%的回報率感到滿意。一般來說,長期回報會讓你比短期回報更好地瞭解業務質量。目前反映在股價中的樂觀情緒是否仍然過多,只有時間才能證明。

While the stock has fallen 4.6% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

儘管該股本週下跌了4.6%,但值得關注的是更長期的,看看這些股票的歷史回報是否受到了基本面因素的推動。

Check out our latest analysis for Tempur Sealy International

查看我們對Tempur Sealy International的最新分析

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

雖然市場是一種強大的定價機制,但股價反映的是投資者情緒,而不僅僅是潛在的企業表現。通過比較每股收益(EPS)和股價隨時間的變化,我們可以感受到投資者對一家公司的態度隨著時間的推移發生了怎樣的變化。

During five years of share price growth, Tempur Sealy International achieved compound earnings per share (EPS) growth of 24% per year. This EPS growth is reasonably close to the 26% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Indeed, it would appear the share price is reacting to the EPS.

在股價增長的五年中,坦普爾Sealy國際公司實現了每股收益(EPS)每年24%的復合增長。這一每股收益增長相當接近該公司股價26%的年均漲幅。這表明投資者對該公司的情緒沒有太大變化。事實上,看起來股價是在對每股收益做出反應。

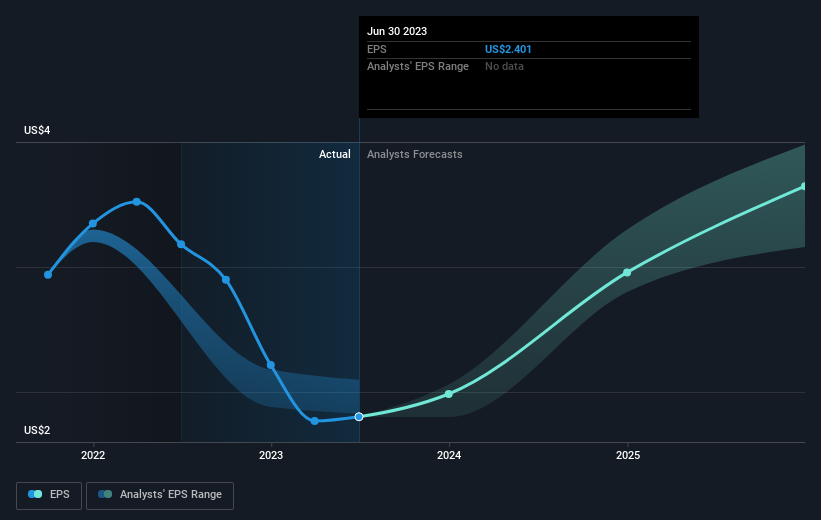

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

您可以在下圖中看到EPS是如何隨著時間的推移而變化的(單擊圖表可查看精確值)。

We know that Tempur Sealy International has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Tempur Sealy International stock, you should check out this FREE detailed report on its balance sheet.

我們知道Tempur Sealy International在過去三年裡提高了利潤,但未來會是什麼樣子?如果您正在考慮購買或出售Tempur Sealy International的股票,您應該查看以下內容免費關於其資產負債表的詳細報告。

What About Dividends?

那股息呢?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Tempur Sealy International's TSR for the last 5 years was 221%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

在考察投資回報時,重要的是要考慮到股東總回報(TSR)和股價回報。TSR包括任何剝離或貼現融資的價值,以及任何股息,基於股息再投資的假設。公平地說,TSR為支付股息的股票提供了更完整的圖景。碰巧的是,Tempur Sealy International過去5年的TSR為221%,超過了前面提到的股價回報。這在很大程度上是其股息支付的結果!

A Different Perspective

不同的視角

It's good to see that Tempur Sealy International has rewarded shareholders with a total shareholder return of 43% in the last twelve months. And that does include the dividend. That's better than the annualised return of 26% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Tempur Sealy International you should be aware of.

很高興看到Tempur Sealy International在過去12個月裡為股東帶來了43%的總回報。這確實包括了股息。這比過去五年26%的年化回報率要好,這意味著該公司最近的表現更好。持樂觀觀點的人可能會認為,最近TSR的改善表明,業務本身正在隨著時間的推移而變得更好。我發現,把股價作為衡量企業業績的長期指標是非常有趣的。但為了真正獲得洞察力,我們還需要考慮其他資訊。一個恰當的例子:我們發現了Tempur Sealy International的2個警告標誌你應該意識到。

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

如果你像我一樣,你會的不想懷念這一切嗎?免費內部人士正在收購的成長型公司名單.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文引用的市場回報反映了目前在美國交易所交易的股票的市場加權平均回報.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.