Nexchip Semiconductor Corporation (SHSE:688249) Doing What It Can To Lift Shares

Nexchip Semiconductor Corporation (SHSE:688249) Doing What It Can To Lift Shares

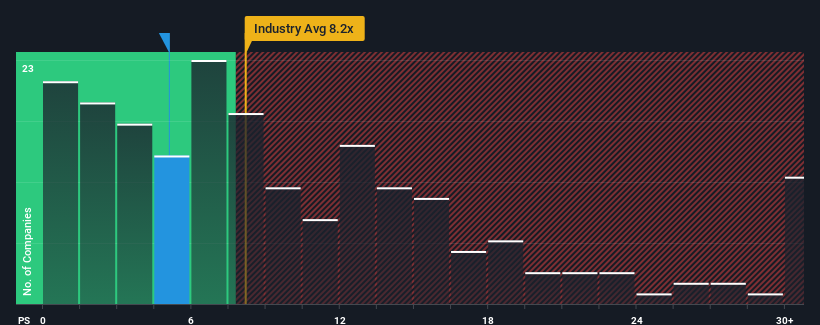

You may think that with a price-to-sales (or "P/S") ratio of 5.1x Nexchip Semiconductor Corporation (SHSE:688249) is a stock worth checking out, seeing as almost half of all the Semiconductor companies in China have P/S ratios greater than 8.2x and even P/S higher than 15x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

你可能会这么认为,市售率(或 “市盈率”)为5.1倍 耐世芯半导体公司 (SHSE: 688249) 是一只值得一看的股票,因为中国几乎有一半的半导体公司的市盈率大于8.2倍,即使市盈率高于15倍也并不罕见。但是,市盈率低可能是有原因的,需要进一步调查才能确定其是否合理。

Check out our latest analysis for Nexchip Semiconductor

查看我们对Nexchip半导体的最新分析

How Nexchip Semiconductor Has Been Performing

Nexchip 半导体的表现如何

While the industry has experienced revenue growth lately, Nexchip Semiconductor's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

尽管该行业最近经历了收入增长,但Nexchip Semiconductor的收入却陷入了逆转,这并不理想。市盈率可能很低,因为投资者认为这种糟糕的收入表现不会好转。如果是这样的话,那么现有股东可能很难对股价的未来走向感到兴奋。

Do Revenue Forecasts Match The Low P/S Ratio?

收入预测是否与低市盈率相符?

The only time you'd be truly comfortable seeing a P/S as low as Nexchip Semiconductor's is when the company's growth is on track to lag the industry.

看到像Nexchip Semiconductor一样低的市盈率只有当公司的增长有望落后于行业时,你才会真正感到舒服。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的26%的下降。最近三年的收入总体增长令人难以置信,与过去的12个月形成鲜明对比。因此,股东会感到高兴,但对于过去的12个月,也有一些严肃的问题需要思考。

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 42% over the next year. That's shaping up to be similar to the 40% growth forecast for the broader industry.

展望未来,报道该公司的一位分析师的估计表明,明年收入将增长42%。这与整个行业40%的增长预测相似。

In light of this, it's peculiar that Nexchip Semiconductor's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

有鉴于此,奇怪的是,Nexchip Semiconductor的市盈率低于大多数其他公司。可能是大多数投资者不相信该公司能够实现未来的增长预期。

The Bottom Line On Nexchip Semiconductor's P/S

Nexchip 半导体市盈率的底线

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

仅使用市销比来确定是否应该出售股票是不明智的,但它可以作为公司未来前景的实用指南。

We've seen that Nexchip Semiconductor currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

我们已经看到,Nexchip Semiconductor目前的市盈率低于预期,因为其预测增长与整个行业一致。尽管估计收入平均增长,但可能存在一些未观察到的威胁,使市盈率保持在较低水平。但是,如果你同意分析师的预测,你也许能够以有吸引力的价格买入股票。

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Nexchip Semiconductor with six simple checks will allow you to discover any risks that could be an issue.

在公司的资产负债表上可以找到许多其他重要的风险因素。我们的 免费的 通过六项简单的检查对Nexchip Semiconductor进行资产负债表分析,您可以发现任何可能存在问题的风险。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是 一定要寻找一家优秀的公司,而不仅仅是你遇到的第一个想法。 因此,如果盈利能力的提高与你对一家优秀公司的想法一致,那就来看看吧 免费的 近期收益增长强劲(市盈率低)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

The only time you'd be truly comfortable seeing a P/S as low as Nexchip Semiconductor's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Nexchip Semiconductor's is when the company's growth is on track to lag the industry.