Today is shaping up negative for Zhejiang Zhengte Co., Ltd. (SZSE:001238) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. Surprisingly the share price has been buoyant, rising 27% to CN¥26.71 in the past 7 days. Whether the downgrade will have a negative impact on demand for shares is yet to be seen.

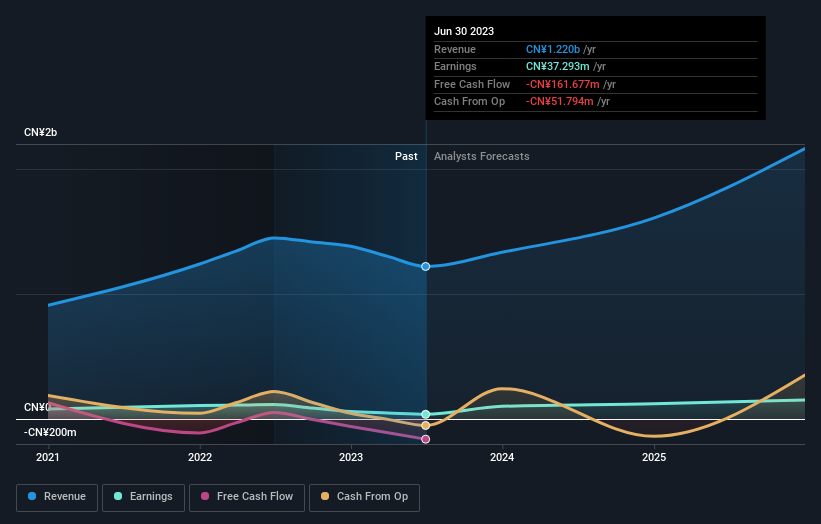

Following the downgrade, the current consensus from Zhejiang Zhengte's twin analysts is for revenues of CN¥1.3b in 2023 which - if met - would reflect a decent 9.3% increase on its sales over the past 12 months. Per-share earnings are expected to jump 108% to CN¥0.70. Previously, the analysts had been modelling revenues of CN¥1.5b and earnings per share (EPS) of CN¥0.95 in 2023. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

Check out our latest analysis for Zhejiang Zhengte

The consensus price target fell 6.9% to CN¥27.00, with the weaker earnings outlook clearly leading analyst valuation estimates.

The consensus price target fell 6.9% to CN¥27.00, with the weaker earnings outlook clearly leading analyst valuation estimates.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One thing stands out from these estimates, which is that Zhejiang Zhengte is forecast to grow faster in the future than it has in the past, with revenues expected to display 9.3% annualised growth until the end of 2023. If achieved, this would be a much better result than the 16% annual decline over the past year. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 11% annually for the foreseeable future. So although Zhejiang Zhengte's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Zhejiang Zhengte after today.

That said, the analysts might have good reason to be negative on Zhejiang Zhengte, given concerns around earnings quality. Learn more, and discover the 2 other flags we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.