The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Better Life Commercial Chain Share Co.,Ltd (SZSE:002251) shareholders. So they might be feeling emotional about the 64% share price collapse, in that time. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Better Life Commercial Chain ShareLtd

Better Life Commercial Chain ShareLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Better Life Commercial Chain ShareLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

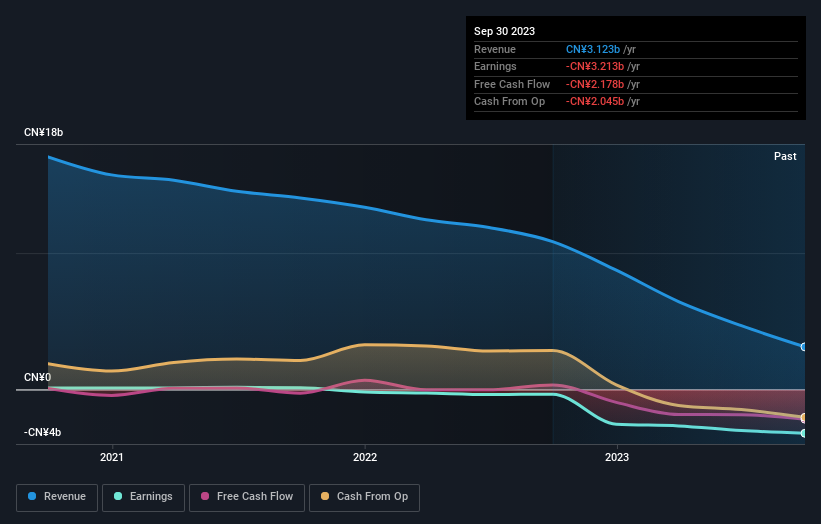

Over the last three years, Better Life Commercial Chain ShareLtd's revenue dropped 39% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 18% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Better Life Commercial Chain ShareLtd shareholders are down 15% for the year. Unfortunately, that's worse than the broader market decline of 3.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Better Life Commercial Chain ShareLtd is showing 3 warning signs in our investment analysis , and 2 of those are a bit concerning...

We will like Better Life Commercial Chain ShareLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.