Potbelly Corporation (NASDAQ:PBPB) shares have had a really impressive month, gaining 30% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 90%.

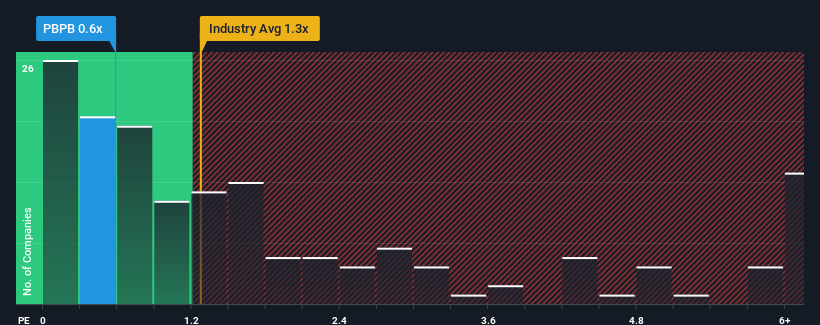

Even after such a large jump in price, given about half the companies operating in the United States' Hospitality industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Potbelly as an attractive investment with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Potbelly

How Potbelly Has Been Performing

With revenue growth that's inferior to most other companies of late, Potbelly has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

With revenue growth that's inferior to most other companies of late, Potbelly has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

How Is Potbelly's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Potbelly's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 53% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.4% as estimated by the four analysts watching the company. With the industry predicted to deliver 17% growth, that's a disappointing outcome.

With this information, we are not surprised that Potbelly is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Potbelly's P/S

Potbelly's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Potbelly's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Potbelly's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Potbelly you should know about.

If you're unsure about the strength of Potbelly's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.