We're Hopeful That Zentalis Pharmaceuticals (NASDAQ:ZNTL) Will Use Its Cash Wisely

We're Hopeful That Zentalis Pharmaceuticals (NASDAQ:ZNTL) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

我們很容易理解爲什麼投資者會被無利可圖的公司所吸引。例如,儘管軟件即服務業務Salesforce.com在經常性收入增長的同時多年虧損,但如果你自2005年以來持有股票,你的表現確實會很好。但是,儘管成功是衆所周知的,但投資者不應忽視許多無利可圖的公司,這些公司只會耗盡所有現金然後倒閉。

So, the natural question for Zentalis Pharmaceuticals (NASDAQ:ZNTL) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

因此,對於Zentalis Pharmicals(納斯達克股票代碼:ZNTL)股東來說,自然而然的問題是他們是否應該擔心其現金消耗率。就本文而言,現金消耗是指無利可圖的公司每年花費現金爲其增長提供資金的比率;其自由現金流爲負。首先,我們將將其現金消耗與現金儲備進行比較,以計算其現金流量。

View our latest analysis for Zentalis Pharmaceuticals

查看我們對Zentalis Pharmicals的最新分析

Does Zentalis Pharmaceuticals Have A Long Cash Runway?

Zentalis Pharmicals 的現金流很長嗎?

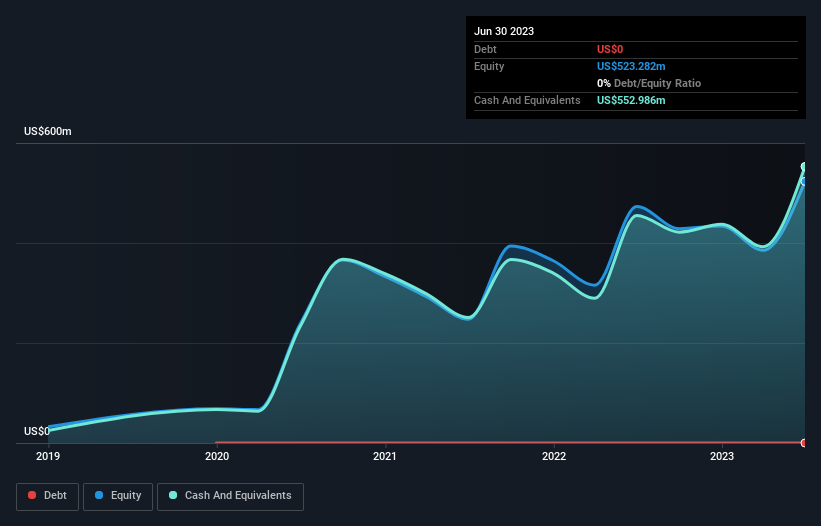

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In June 2023, Zentalis Pharmaceuticals had US$553m in cash, and was debt-free. In the last year, its cash burn was US$201m. Therefore, from June 2023 it had 2.7 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. Depicted below, you can see how its cash holdings have changed over time.

公司的現金跑道是指按當前的現金消耗率耗盡現金儲備所需的時間。2023年6月,Zentalis製藥擁有5.53億美元的現金,並且沒有債務。去年,其現金消耗爲2.01億美元。因此,從2023年6月起,它有2.7年的現金週期。可以說,這是一條謹慎而合理的跑道長度。如下所示,您可以看到其現金持有量隨着時間的推移發生了怎樣的變化。

How Is Zentalis Pharmaceuticals' Cash Burn Changing Over Time?

隨着時間的推移,Zentalis Pharmicals的現金消耗如何變化?

Because Zentalis Pharmaceuticals isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 19%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

由於Zentalis製藥公司目前沒有創造收入,因此我們認爲這是一項處於早期階段的業務。因此,儘管我們無法通過銷售來了解增長,但我們可以看看現金消耗是如何變化的,以了解支出隨着時間的推移而呈現的趨勢。在過去的一年中,其現金消耗實際上增加了19%,這表明管理層正在增加對未來增長的投資,但速度不會太快。這不一定是一件壞事,但投資者應注意這樣一個事實,這將縮短現金流道。雖然過去總是值得研究的,但最重要的是未來。因此,你可能想看看該公司在未來幾年預計將增長多少。

How Hard Would It Be For Zentalis Pharmaceuticals To Raise More Cash For Growth?

Zentalis Pharmicals爲增長籌集更多現金會有多難?

Given its cash burn trajectory, Zentalis Pharmaceuticals shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

鑑於其現金消耗軌跡,Zentalis Pharmicals的股東們不妨考慮儘管現金流穩健,但它能多麼容易地籌集更多現金。一般而言,上市企業可以通過發行股票或承擔債務來籌集新現金。上市公司的主要優勢之一是,它們可以向投資者出售股票以籌集現金和爲增長提供資金。我們可以將公司的現金消耗與其市值進行比較,以了解公司必須發行多少新股才能爲一年的運營提供資金。

Zentalis Pharmaceuticals' cash burn of US$201m is about 16% of its US$1.3b market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Zentalis Pharmicals的2.01億美元現金消耗約佔其13億美元市值的16%。因此,我們冒險該公司可以毫不費力地籌集更多現金用於增長,儘管要付出一些攤薄的代價。

Is Zentalis Pharmaceuticals' Cash Burn A Worry?

Zentalis Pharmicals 的現金消耗令人擔憂嗎?

On this analysis of Zentalis Pharmaceuticals' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, Zentalis Pharmaceuticals has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

根據對Zentalis Pharmaceuticals現金消耗的分析,我們認爲其現金流道令人放心,而其不斷增加的現金消耗讓我們有些擔憂。考慮到本文中討論的所有因素,儘管我們確實認爲股東應該密切關注公司的發展情況,但我們並不過分擔心公司的現金消耗。另一方面,Zentalis Pharmicals有3個警告信號(還有一個有點不愉快),我們認爲你應該知道。

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

當然,通過尋找其他地方,你可能會找到一項不錯的投資。因此,看看這份有趣的公司的免費清單,以及這份股票成長股清單(根據分析師的預測)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。