Nanjing Vazyme Biotech Co.,Ltd (SHSE:688105) shareholders have had their patience rewarded with a 25% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

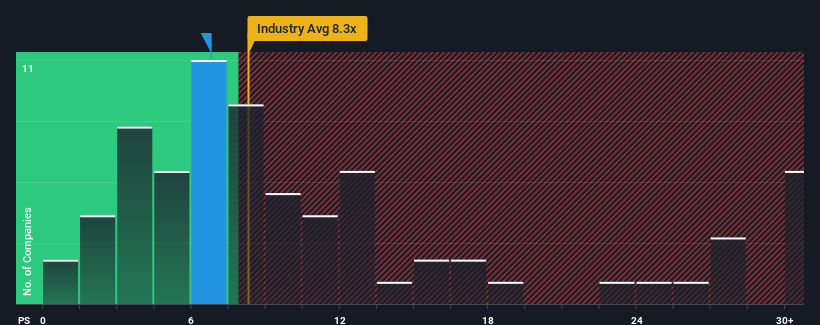

Even after such a large jump in price, there still wouldn't be many who think Nanjing Vazyme BiotechLtd's price-to-sales (or "P/S") ratio of 6.8x is worth a mention when the median P/S in China's Biotechs industry is similar at about 8.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Nanjing Vazyme BiotechLtd

What Does Nanjing Vazyme BiotechLtd's P/S Mean For Shareholders?

Nanjing Vazyme BiotechLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nanjing Vazyme BiotechLtd.Is There Some Revenue Growth Forecasted For Nanjing Vazyme BiotechLtd?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nanjing Vazyme BiotechLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 24% over the next year. With the industry predicted to deliver 465% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Nanjing Vazyme BiotechLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Nanjing Vazyme BiotechLtd's P/S?

Its shares have lifted substantially and now Nanjing Vazyme BiotechLtd's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our check of Nanjing Vazyme BiotechLtd's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Nanjing Vazyme BiotechLtd (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Nanjing Vazyme BiotechLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.