David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Jiangxi Firstar Panel Technology Co.,Ltd. (SZSE:300256) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Jiangxi Firstar Panel TechnologyLtd

How Much Debt Does Jiangxi Firstar Panel TechnologyLtd Carry?

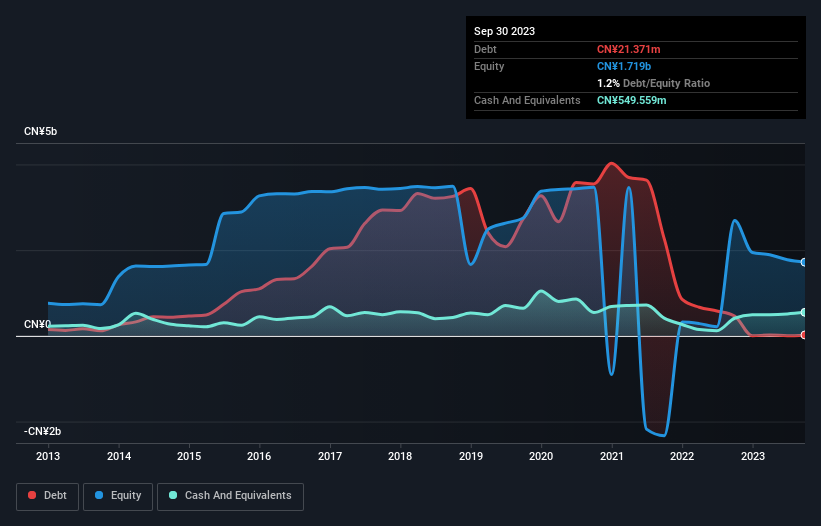

You can click the graphic below for the historical numbers, but it shows that Jiangxi Firstar Panel TechnologyLtd had CN¥21.4m of debt in September 2023, down from CN¥464.1m, one year before. However, it does have CN¥549.6m in cash offsetting this, leading to net cash of CN¥528.2m.

You can click the graphic below for the historical numbers, but it shows that Jiangxi Firstar Panel TechnologyLtd had CN¥21.4m of debt in September 2023, down from CN¥464.1m, one year before. However, it does have CN¥549.6m in cash offsetting this, leading to net cash of CN¥528.2m.

How Healthy Is Jiangxi Firstar Panel TechnologyLtd's Balance Sheet?

The latest balance sheet data shows that Jiangxi Firstar Panel TechnologyLtd had liabilities of CN¥683.4m due within a year, and liabilities of CN¥108.0m falling due after that. On the other hand, it had cash of CN¥549.6m and CN¥626.5m worth of receivables due within a year. So it can boast CN¥384.8m more liquid assets than total liabilities.

This short term liquidity is a sign that Jiangxi Firstar Panel TechnologyLtd could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Jiangxi Firstar Panel TechnologyLtd boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Jiangxi Firstar Panel TechnologyLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Jiangxi Firstar Panel TechnologyLtd had a loss before interest and tax, and actually shrunk its revenue by 20%, to CN¥845m. We would much prefer see growth.

So How Risky Is Jiangxi Firstar Panel TechnologyLtd?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Jiangxi Firstar Panel TechnologyLtd had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥77m and booked a CN¥965m accounting loss. Given it only has net cash of CN¥528.2m, the company may need to raise more capital if it doesn't reach break-even soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Jiangxi Firstar Panel TechnologyLtd has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.