We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Liberty Latin America Ltd. (NASDAQ:LILA) share price dropped 63% over five years. That's not a lot of fun for true believers. And we doubt long term believers are the only worried holders, since the stock price has declined 20% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 33% in the last 90 days.

Since Liberty Latin America has shed US$54m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Liberty Latin America

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Liberty Latin America moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Revenue is actually up 7.1% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

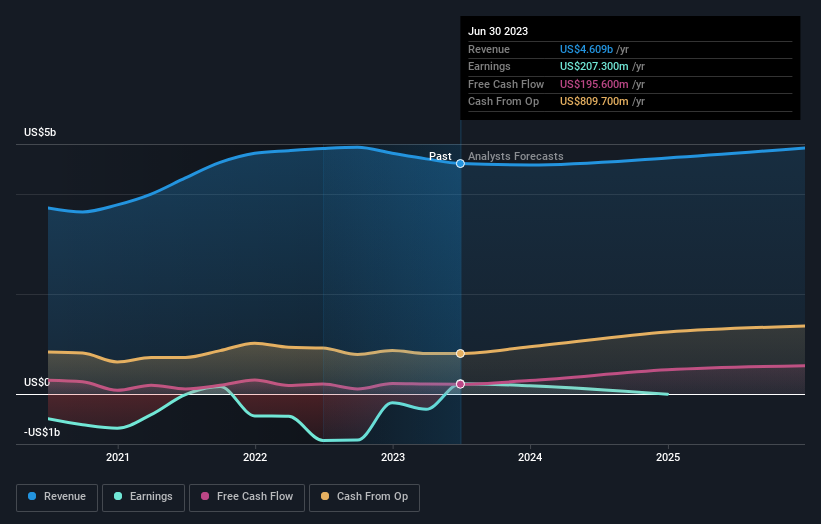

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Liberty Latin America has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Liberty Latin America will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 15% in the last year, Liberty Latin America shareholders lost 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Liberty Latin America better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Liberty Latin America (including 2 which shouldn't be ignored) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.