HPF Co.,Ltd (SZSE:300350) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 9.6% isn't as impressive.

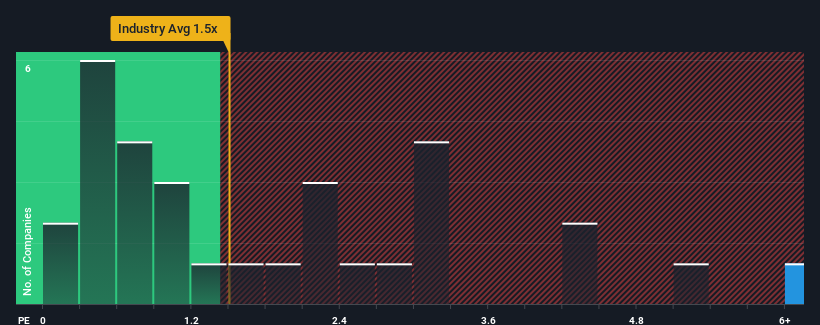

After such a large jump in price, you could be forgiven for thinking HPFLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in China's Logistics industry have P/S ratios below 1.5x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for HPFLtd

What Does HPFLtd's Recent Performance Look Like?

For example, consider that HPFLtd's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on HPFLtd's earnings, revenue and cash flow.How Is HPFLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as HPFLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that HPFLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

HPFLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that HPFLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with HPFLtd (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If you're unsure about the strength of HPFLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.