On November 9, Gelonghui's coal stocks rose.The rise and fall of cloud coal energy,Pingmei shares, Jinkong Coal, Shanxi Coking Coal, Huaibei Mining, and Yankuang Energy followed suit.

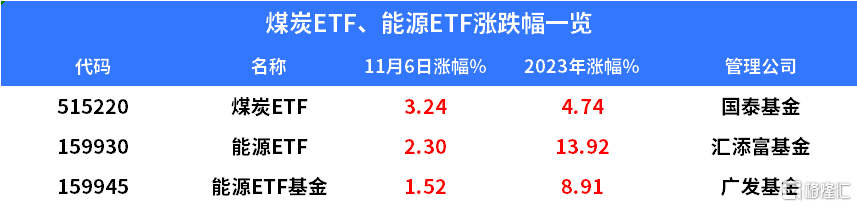

In terms of ETFs, Cathay Pacific's coal ETF rose by more than 3%, while Huitianfu Fund's Energy ETF and Guangfa Fund's Energy ETF Fund followed suit.

Major coking coal contracts of major trading firms rose more than 3%, a record high in the past eight months.

According to news, some northern regions have officially entered the heating season, and terminal coal demand has increased rapidly, driving coal prices to rise continuously in the short term.

According to China Energy News, in November, the northern region is entering the heating season one after another. In order to do a good job in energy insurance and supply this winter, the relevant national authorities have deployed in advance to prepare for the peak winter season. At a press conference held recently by the National Energy Administration, the relevant person in charge of the National Energy Administration explained that in the first three quarters of this year, the energy industry took a number of measures to increase energy production and supply. Raw coal, crude oil, and natural gas production increased steadily, successfully completing the peak summer power supply guarantee. The next step is to plan and deploy early, and take more measures to ensure a safe and stable supply of electricity in winter.

Institutions are optimistic about coal stocks. According to the Tianfeng Securities Research Report, coal mine production load has increased, safety supervision has become stricter, and supply is shrinking incrementally. Judging from this year's safety supervision policy, safety inspections may not be relaxed in the future, and there is even a possibility that security checks will be normalized. It is expected that subsequent coal supply will still be tight. This may also be one of the core reasons why security checks continued to be strong in July-September this year. Quantitative changes led to qualitative changes, which in turn led to rising coal prices. Coal prices have always had seasonal characteristics, but this year they are more flexible. Looking at the long term, the increase in coal supply may be further tightened in the future, and the problem of resource depletion in mines cannot be ignored. It is expected that the tight balance will not change, and the coal price center may rise.

CITIC Securities pointed out that there is still an opportunity for catalysts to resonate in the fourth quarter, and the coal sector market may fluctuate upward. Although short-term coal prices have fluctuated, they have remained high. After that, under the superposition of a series of policies, there is still room for coal demand and coal prices to rebound, and coal prices are expected to rise further. At the same time, we expect that market styles such as procyclical and dividend returns will continue to increase sector attention in the fourth quarter, and the sector may show a volatile upward rhythm during the year. It is proposed to allocate companies along two main lines: one is Lu'an Huaneng Energy and Yankuang Energy, etc., which have continuous dividend ability and good stock price elasticity; the second is Pingmei shares, Huaibei Mining, China Coal Energy, etc. with low P/B valuations but relatively good performance.

Open source securities maintain the logical recommendation of a high win rate and a high margin of safety in the coal sector, and have both offense and defense: in terms of high win rates, high dividends have gradually been favored by capital market capital, and high dividends for coal companies have become a major trend; currently, with the introduction of a steady growth policy and exceeding expectations, coal stocks will also become an aggressive breed. As an upstream resource link, it is bound to be boosted by downstream demand, reflecting price increases. In terms of safety, we believe that the valuation of coal stocks is already at the bottom of history. PE valuations are 5-6 times the corresponding performance in 2023. Using the PB-ROE method to analyze the high ROE of coal stocks, PB is drastically discounted, and the value of coal companies is underestimated.

ICBC Credit Suisse Fund recently issued an opinion stating that the National Development and Reform Commission recently issued the “Notice on Accomplishing the Signing and Execution of Medium- and Long-Term Electricity and Coal Contracts in 2024". The “Notice” is more flexible and pragmatic than in 2023. In terms of quantity, the volume requirements for the demand side have been relaxed, but the requirements for the volume of tasks on the supplier side have not changed; in terms of performance, the annual performance rate is still 100%, but there is more room for quarterly and monthly adjustments. ICBC Credit Suisse Fund believes that the long-term cooperation mechanism can play the role of ballast stone and stabilizer in the coal market, and the overall long-term cooperation volume in 2024 is expected to remain stable. Listed coal companies have sustainable high profits and high dividends. Using the conservative coal price of 700 yuan/ton as an assumption, the sector's dividend ratio is still very attractive. In the future, we can focus on the driving effect of economic recovery and policy strength on the demand side.