For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Wuxi Autowell TechnologyLtd (SHSE:688516), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Wuxi Autowell TechnologyLtd

How Fast Is Wuxi Autowell TechnologyLtd Growing Its Earnings Per Share?

In the last three years Wuxi Autowell TechnologyLtd's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Wuxi Autowell TechnologyLtd's EPS soared from CN¥4.29 to CN¥7.07, over the last year. That's a commendable gain of 65%.

In the last three years Wuxi Autowell TechnologyLtd's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Wuxi Autowell TechnologyLtd's EPS soared from CN¥4.29 to CN¥7.07, over the last year. That's a commendable gain of 65%.

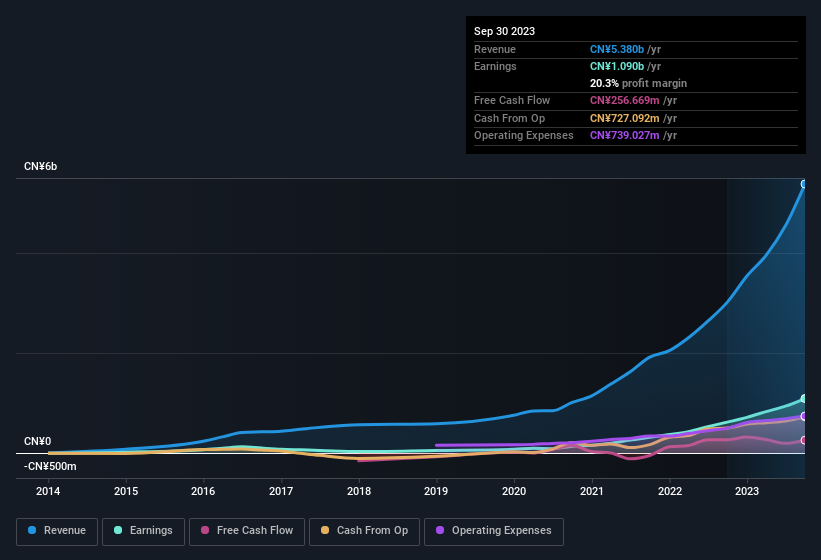

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Wuxi Autowell TechnologyLtd remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 78% to CN¥5.4b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Wuxi Autowell TechnologyLtd?

Are Wuxi Autowell TechnologyLtd Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Wuxi Autowell TechnologyLtd will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. At the current share price, that insider holding is worth a staggering CN¥11b. This is an incredible endorsement from them.

Should You Add Wuxi Autowell TechnologyLtd To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Wuxi Autowell TechnologyLtd's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. We should say that we've discovered 2 warning signs for Wuxi Autowell TechnologyLtd (1 is potentially serious!) that you should be aware of before investing here.

Although Wuxi Autowell TechnologyLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.