When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. On that note, looking into GCL System Integration Technology (SZSE:002506), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on GCL System Integration Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.058 = CN¥223m ÷ (CN¥14b - CN¥10b) (Based on the trailing twelve months to September 2023).

0.058 = CN¥223m ÷ (CN¥14b - CN¥10b) (Based on the trailing twelve months to September 2023).

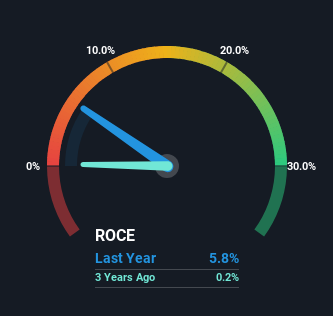

Thus, GCL System Integration Technology has an ROCE of 5.8%. On its own that's a low return, but compared to the average of 4.2% generated by the Semiconductor industry, it's much better.

See our latest analysis for GCL System Integration Technology

Above you can see how the current ROCE for GCL System Integration Technology compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

So How Is GCL System Integration Technology's ROCE Trending?

We aren't too thrilled by the trend because ROCE has declined 35% over the last five years and despite the capital raising conducted before the latest reports, the business has -23% less capital employed.

On a side note, GCL System Integration Technology's current liabilities are still rather high at 73% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On GCL System Integration Technology's ROCE

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 44% over the last five years, so it looks like investors are recognizing these changes. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

Like most companies, GCL System Integration Technology does come with some risks, and we've found 1 warning sign that you should be aware of.

While GCL System Integration Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.