Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Onto Innovation (NYSE:ONTO) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Onto Innovation, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = US$180m ÷ (US$1.8b - US$137m) (Based on the trailing twelve months to July 2023).

0.11 = US$180m ÷ (US$1.8b - US$137m) (Based on the trailing twelve months to July 2023).

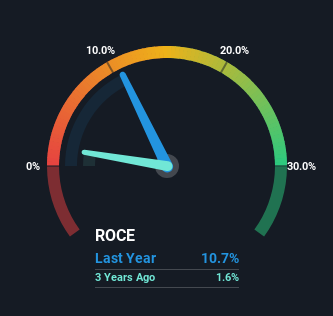

Thus, Onto Innovation has an ROCE of 11%. By itself that's a normal return on capital and it's in line with the industry's average returns of 11%.

View our latest analysis for Onto Innovation

Above you can see how the current ROCE for Onto Innovation compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Onto Innovation.

How Are Returns Trending?

On the surface, the trend of ROCE at Onto Innovation doesn't inspire confidence. Around five years ago the returns on capital were 15%, but since then they've fallen to 11%. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

What We Can Learn From Onto Innovation's ROCE

To conclude, we've found that Onto Innovation is reinvesting in the business, but returns have been falling. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 212% gain to shareholders who have held over the last three years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you're still interested in Onto Innovation it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.