Little Excitement Around Semantix, Inc.'s (NASDAQ:STIX) Revenues As Shares Take 52% Pounding

Little Excitement Around Semantix, Inc.'s (NASDAQ:STIX) Revenues As Shares Take 52% Pounding

Semantix, Inc. (NASDAQ:STIX) shareholders that were waiting for something to happen have been dealt a blow with a 52% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

Semantix, Inc. 上个月,纳斯达克股票代码:STIX)股东受到了打击,股价下跌了52%。在过去十二个月中已经持股的股东非但没有获得奖励,反而坐视股价下跌了49%。

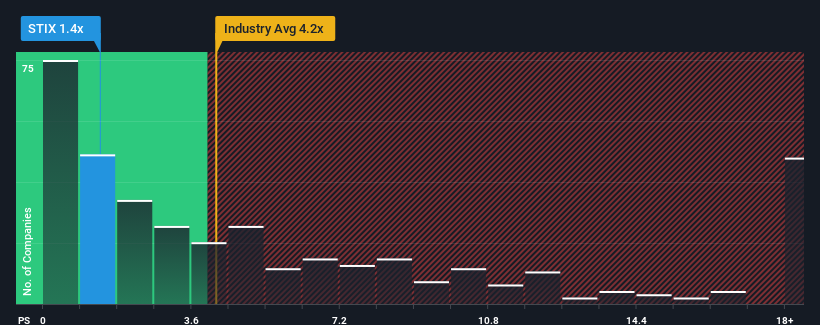

Since its price has dipped substantially, Semantix may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.2x and even P/S higher than 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

鉴于其价格已大幅下跌,Semantix目前看上去是一个强劲的买入机会,其市盈率(或 “市盈率”)为1.4倍,考虑到美国软件行业几乎有一半的市盈率超过4.2倍,甚至市盈率高于10倍也不是罕见的。但是,仅按面值计算市盈率是不明智的,因为可能可以解释为什么市盈率如此有限。

View our latest analysis for Semantix

查看我们对Semantix的最新分析

How Semantix Has Been Performing

Semantix 的表现如何

With revenue growth that's inferior to most other companies of late, Semantix has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

由于最近收入增长不如大多数其他公司,Semantix表现相对缓慢。似乎许多人预计平淡无奇的收入表现将持续下去,这抑制了市盈率的增长。如果是这样的话,那么现有股东可能很难对股价的未来走向感到兴奋。

Is There Any Revenue Growth Forecasted For Semantix?

Semantix有收入增长的预测吗?

Semantix's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

对于一家预计增长非常糟糕甚至收入下降的公司来说,Semantix的市盈率是典型的,更重要的是,其表现要比行业差得多。

Retrospectively, the last year delivered a decent 7.8% gain to the company's revenues. The latest three year period has also seen an excellent 81% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

回顾过去,去年该公司的收入实现了可观的7.8%的增长。在最近的三年中,总体收入也实现了81%的出色增长,这在一定程度上得益于其短期表现。因此,股东们肯定会欢迎这些中期收入增长率。

Looking ahead now, revenue is anticipated to slump, contracting by 28% during the coming year according to the sole analyst following the company. That's not great when the rest of the industry is expected to grow by 15%.

展望未来,预计收入将下滑,据该公司的唯一分析师称,来年收入将萎缩28%。当该行业的其他部门预计将增长15%时,这并不好。

With this in consideration, we find it intriguing that Semantix's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

考虑到这一点,我们发现有趣的是,Semantix的市盈率与行业同行非常接近。尽管如此,还不能保证市盈率已经达到下限,而收入却相反。即使仅仅维持这些价格也可能难以实现,因为疲软的前景正在压低股价。

The Final Word

最后一句话

Having almost fallen off a cliff, Semantix's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

在差点跌下悬崖之后,Semantix的股价也拉低了市盈率。尽管市销比不应该成为决定你是否买入股票的决定性因素,但它是衡量收入预期的有力晴雨表。

It's clear to see that Semantix maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

很明显,由于收入下滑的预测疲软,Semantix维持了较低的市盈率,正如预期的那样。在现阶段,投资者认为收入改善的可能性不足以证明提高市盈率是合理的。在这种情况下,很难看到股价在不久的将来强劲上涨。

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Semantix (3 are concerning) you should be aware of.

别忘了可能还有其他风险。例如,我们已经确定了 Semantix 的 4 个警告标志 (3 个令人担忧)你应该知道。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是 一定要寻找一家优秀的公司,而不仅仅是你遇到的第一个想法。 因此,如果盈利能力的提高与你对一家优秀公司的想法一致,那就来看看吧 免费的 近期收益增长强劲(市盈率低)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。