Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Guangzhou Haozhi Industrial Co.,Ltd. (SZSE:300503) shareholders have enjoyed a 84% share price rise over the last half decade, well in excess of the market return of around 28% (not including dividends).

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Guangzhou Haozhi IndustrialLtd

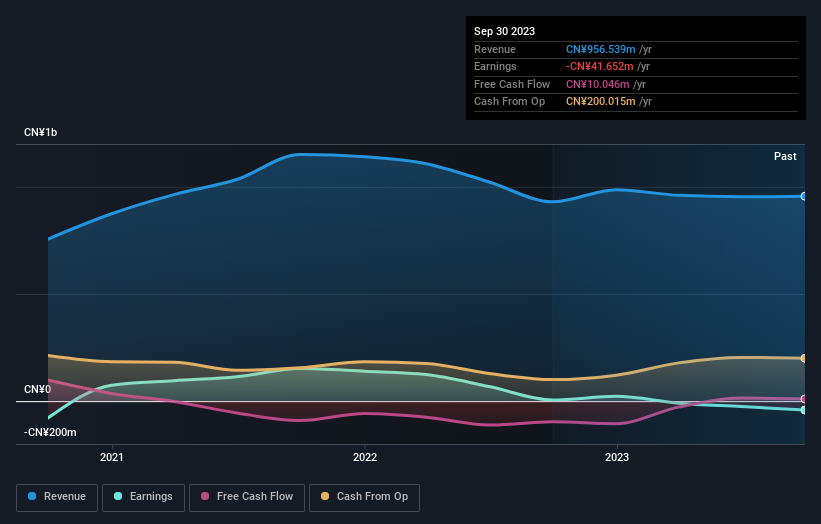

Given that Guangzhou Haozhi IndustrialLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Given that Guangzhou Haozhi IndustrialLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Guangzhou Haozhi IndustrialLtd can boast revenue growth at a rate of 19% per year. That's well above most pre-profit companies. It's good to see that the stock has 13%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at Guangzhou Haozhi IndustrialLtd. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Guangzhou Haozhi IndustrialLtd stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Guangzhou Haozhi IndustrialLtd's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Guangzhou Haozhi IndustrialLtd's TSR of 87% over the last 5 years is better than the share price return.

A Different Perspective

It's nice to see that Guangzhou Haozhi IndustrialLtd shareholders have received a total shareholder return of 74% over the last year. That gain is better than the annual TSR over five years, which is 13%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Guangzhou Haozhi IndustrialLtd better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Guangzhou Haozhi IndustrialLtd (of which 1 is concerning!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.