SOPHiA GENETICS SA (NASDAQ:SOPH) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 105% following the latest surge, making investors sit up and take notice.

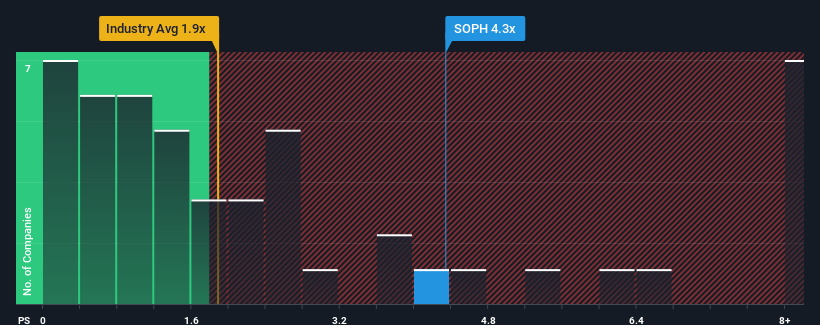

After such a large jump in price, given around half the companies in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider SOPHiA GENETICS as a stock to avoid entirely with its 4.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for SOPHiA GENETICS

How Has SOPHiA GENETICS Performed Recently?

With revenue growth that's superior to most other companies of late, SOPHiA GENETICS has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

With revenue growth that's superior to most other companies of late, SOPHiA GENETICS has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Is There Enough Revenue Growth Forecasted For SOPHiA GENETICS?

The only time you'd be truly comfortable seeing a P/S as steep as SOPHiA GENETICS' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The latest three year period has also seen an excellent 107% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 29% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader industry.

In light of this, it's understandable that SOPHiA GENETICS' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From SOPHiA GENETICS' P/S?

Shares in SOPHiA GENETICS have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of SOPHiA GENETICS' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with SOPHiA GENETICS, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.