Returns Are Gaining Momentum At GXO Logistics (NYSE:GXO)

Returns Are Gaining Momentum At GXO Logistics (NYSE:GXO)

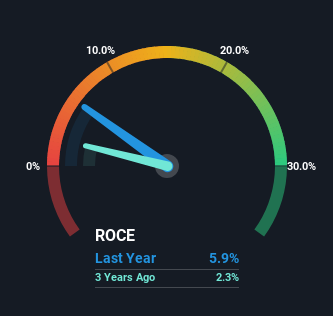

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in GXO Logistics' (NYSE:GXO) returns on capital, so let's have a look.

我们应该寻找哪些早期趋势来确定一只可能长期价值成倍增长的股票?通常,我们希望注意到增长的趋势 返回 在资本使用率(ROCE)方面,除此之外,还在扩大 基础 已动用资本的百分比。如果你看到这一点,那通常意味着它是一家拥有良好商业模式和大量有利可图的再投资机会的公司。说到这里,我们注意到GXO Logistics(纽约证券交易所代码:GXO)的资本回报率有一些重大变化,所以让我们来看看吧。

Understanding Return On Capital Employed (ROCE)

了解资本使用回报率 (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on GXO Logistics is:

如果你以前没有与ROCE合作过,它可以衡量一家公司从其业务中使用的资本中产生的 “回报”(税前利润)。GXO Logistics 的计算公式为:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

已动用资本回报率 = 息税前收益 (EBIT) ¥(总资产-流动负债)

0.059 = US$394m ÷ (US$9.1b - US$2.4b) (Based on the trailing twelve months to September 2023).

0.059 = 3.94 亿美元 ¥(91 亿美元至 24 亿美元) (基于截至2023年9月的过去十二个月)。

Thus, GXO Logistics has an ROCE of 5.9%. In absolute terms, that's a low return and it also under-performs the Logistics industry average of 13%.

因此,GXO Logistics的投资回报率为5.9%。从绝对值来看,这是一个低回报,而且表现也低于物流行业13%的平均水平。

View our latest analysis for GXO Logistics

查看我们对GXO Logistics的最新分析

Above you can see how the current ROCE for GXO Logistics compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for GXO Logistics.

在上方你可以看到GXO Logistics当前的投资回报率与之前的资本回报率相比如何,但从过去可以看出来只有这么多。如果你想了解分析师对未来的预测,你应该查看我们为GXO Logistics提供的免费报告。

What Does the ROCE Trend For GXO Logistics Tell Us?

GXO 物流的 ROCE 趋势告诉我们什么?

We're glad to see that ROCE is heading in the right direction, even if it is still low at the moment. The data shows that returns on capital have increased substantially over the last three years to 5.9%. Basically the business is earning more per dollar of capital invested and in addition to that, 39% more capital is being employed now too. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, a combination that's common among multi-baggers.

我们很高兴看到ROCE正朝着正确的方向前进,尽管目前仍处于低位。数据显示,在过去三年中,资本回报率已大幅提高至5.9%。基本上,企业每投资1美元的资本就能获得更多的收入,除此之外,现在使用的资本也增加了39%。这可能表明,内部投资资本的机会很多,而且利率越来越高,这种组合在多元化企业中很常见。

Our Take On GXO Logistics' ROCE

我们对 GXO Logistics 投资回报率的看法

All in all, it's terrific to see that GXO Logistics is reaping the rewards from prior investments and is growing its capital base. And with a respectable 35% awarded to those who held the stock over the last year, you could argue that these developments are starting to get the attention they deserve. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

总而言之,看到GXO Logistics从先前的投资中获得回报并正在扩大其资本基础,真是太棒了。而且,去年持有该股的人获得了可观的35%,你可以争辩说,这些发展已开始得到应有的关注。因此,鉴于该股已证明其趋势乐观,值得进一步研究该公司,看看这些趋势是否可能持续下去。

On a separate note, we've found 1 warning sign for GXO Logistics you'll probably want to know about.

另一方面,我们发现了 GXO Logistics 的 1 个警告信号,你可能想知道。

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

如果你想寻找收益丰厚的稳健公司,可以免费查看这份资产负债表良好且股本回报率可观的公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

0.059 = US$394m ÷ (US$9.1b - US$2.4b) (Based on the trailing twelve months to September 2023).

0.059 = US$394m ÷ (US$9.1b - US$2.4b) (Based on the trailing twelve months to September 2023).