The Air T, Inc. (NASDAQ:AIRT) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

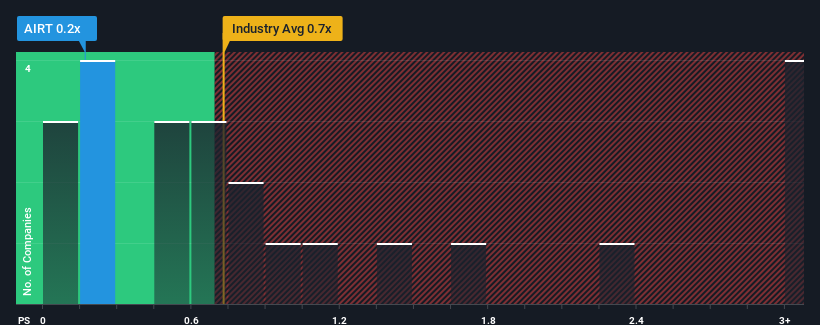

Following the heavy fall in price, considering around half the companies operating in the United States' Logistics industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider Air T as an solid investment opportunity with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Air T

NasdaqGM:AIRT Price to Sales Ratio vs Industry November 20th 2023

NasdaqGM:AIRT Price to Sales Ratio vs Industry November 20th 2023

How Air T Has Been Performing

Recent times have been quite advantageous for Air T as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Air T will help you shine a light on its historical performance.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Air T's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Pleasingly, revenue has also lifted 35% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 2.1% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Air T's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Air T's P/S

Air T's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Air T revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Air T is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If these risks are making you reconsider your opinion on Air T, explore our interactive list of high quality stocks to get an idea of what else is out there.