The Shanghai Sunglow Packaging Technology Co.,Ltd (SHSE:603499) share price has done very well over the last month, posting an excellent gain of 39%. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

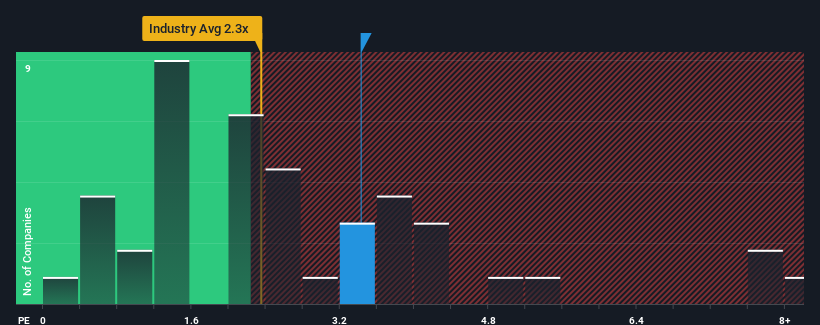

Since its price has surged higher, you could be forgiven for thinking Shanghai Sunglow Packaging TechnologyLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in China's Packaging industry have P/S ratios below 2.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Shanghai Sunglow Packaging TechnologyLtd

What Does Shanghai Sunglow Packaging TechnologyLtd's Recent Performance Look Like?

Recent times have been pleasing for Shanghai Sunglow Packaging TechnologyLtd as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Recent times have been pleasing for Shanghai Sunglow Packaging TechnologyLtd as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

How Is Shanghai Sunglow Packaging TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Shanghai Sunglow Packaging TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.4% gain to the company's revenues. The latest three year period has also seen an excellent 68% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 34% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Shanghai Sunglow Packaging TechnologyLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shanghai Sunglow Packaging TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Shanghai Sunglow Packaging TechnologyLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Packaging industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shanghai Sunglow Packaging TechnologyLtd that you should be aware of.

If these risks are making you reconsider your opinion on Shanghai Sunglow Packaging TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.