Is Giantec Semiconductor Corporation's (SHSE:688123) Latest Stock Performance A Reflection Of Its Financial Health?

Is Giantec Semiconductor Corporation's (SHSE:688123) Latest Stock Performance A Reflection Of Its Financial Health?

Giantec Semiconductor (SHSE:688123) has had a great run on the share market with its stock up by a significant 21% over the last three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Giantec Semiconductor's ROE.

Giantec Semiconductor(上海证券交易所代码:688123)在股票市场上表现良好,其股票在过去三个月中大幅上涨了21%。鉴于公司的出色表现,我们决定更仔细地研究其财务指标,因为公司的长期财务状况通常决定市场业绩。在本文中,我们决定重点关注 Giantec 半导体的投资回报率。

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

股本回报率或投资回报率是对公司价值增长和管理投资者资金的有效性的考验。简而言之,它用于评估公司相对于其股权资本的盈利能力。

See our latest analysis for Giantec Semiconductor

查看我们对 Giantec 半导体的最新分析

How Do You Calculate Return On Equity?

你如何计算股本回报率?

The formula for ROE is:

投资回报率的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回报率 = 净利润(来自持续经营)÷ 股东权益

So, based on the above formula, the ROE for Giantec Semiconductor is:

因此,根据上述公式,Giantec Semiconductor的投资回报率为:

8.5% = CN¥162m ÷ CN¥1.9b (Based on the trailing twelve months to September 2023).

8.5% = 1.62亿元人民币 ¥190亿元人民币(基于截至2023年9月的过去十二个月)。

The 'return' is the income the business earned over the last year. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.08 in profit.

“回报” 是企业在过去一年中获得的收入。另一种思考方式是,每持有价值1元人民币的股权,该公司就能获得0.08元人民币的利润。

What Is The Relationship Between ROE And Earnings Growth?

投资回报率与收益增长之间有什么关系?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前为止,我们已经了解到,投资回报率是衡量公司盈利能力的指标。根据公司选择再投资或 “保留” 的利润金额,我们随后能够评估公司未来的盈利能力。假设其他一切都保持不变,那么与不一定具有这些特征的公司相比,投资回报率和利润保留率越高,公司的增长率就越高。

A Side By Side comparison of Giantec Semiconductor's Earnings Growth And 8.5% ROE

Giantec Semiconductor的收益增长和8.5%的投资回报率的并排比较

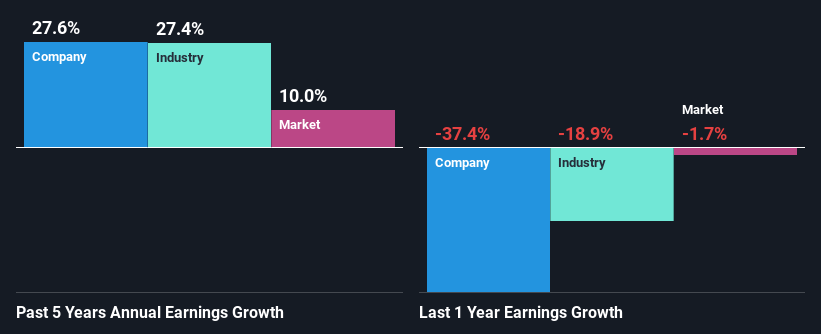

At first glance, Giantec Semiconductor's ROE doesn't look very promising. However, the fact that the its ROE is quite higher to the industry average of 6.1% doesn't go unnoticed by us. Even more so after seeing Giantec Semiconductor's exceptional 28% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. So, there might well be other reasons for the earnings to grow. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

乍一看,Giantec Semiconductor的投资回报率看起来并不十分乐观。但是,其投资回报率远高于行业平均水平的6.1%,这一事实并没有被我们忽视。在看到Giantec Semiconductor在过去五年中实现了28%的惊人净收入增长之后,更是如此。请记住,该公司的投资回报率确实适度低。只是行业的投资回报率较低。因此,收益增长很可能还有其他原因。例如,整个行业可能正在经历高增长阶段,或者该公司的派息率很低。

Next, on comparing Giantec Semiconductor's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 27% over the last few years.

接下来,在将Giantec Semiconductor的净收入增长与该行业的净收入增长进行比较时,我们发现该公司报告的增长与过去几年27%的行业平均增长率相似。

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Giantec Semiconductor's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

收益增长是股票估值的重要因素。无论如何,投资者应设法确定预期的收益增长或下降是否已计入其中。通过这样做,他们将知道股票是走向清澈的蓝色海水还是沼泽水域在等着呢。如果你想知道Giantec Semiconductor的估值,可以看看这个衡量其与行业相比的市盈率指标。

Is Giantec Semiconductor Making Efficient Use Of Its Profits?

巨人半导体能否有效利用其利润?

The three-year median payout ratio for Giantec Semiconductor is 30%, which is moderately low. The company is retaining the remaining 70%. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Giantec Semiconductor is reinvesting its earnings efficiently.

巨人半导体的三年中位数支付率为30%,略低。该公司保留了剩余的70%。这表明其股息已得到充分保障,鉴于我们上面讨论的高增长,巨人半导体似乎正在有效地对其收益进行再投资。

Besides, Giantec Semiconductor has been paying dividends over a period of three years. This shows that the company is committed to sharing profits with its shareholders.

此外,Giantec 半导体已经在三年内派发了股息。这表明该公司致力于与股东分享利润。

Summary

摘要

Overall, we are quite pleased with Giantec Semiconductor's performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

总的来说,我们对Giantec半导体的表现非常满意。特别是,我们喜欢该公司以适度的回报率对其业务进行大量再投资。毫不奇怪,这带来了令人印象深刻的收益增长。话虽如此,最新的行业分析师预测显示,该公司的收益有望加速。这些分析师的预期是基于对该行业的广泛预期,还是基于公司的基本面?点击此处进入我们分析师对公司的预测页面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

The formula for ROE is:

The formula for ROE is: