11月21日,名创优品交出截至2023年9月30日止的FY2024Q1季度财报。堪称史上最强业绩,营收、毛利率、净利润等多项数据均取得历史性的突破。

披露期营收37.91亿/yoy+36.7%。其中海外收入12.95亿元/yoy+40.8%,国内收入24.96亿元/yoy+34.7%。海外收入增速超过国内。

毛利率首次突破40%,达41.8%/+6.1pct;经调整净利润6.4亿/+54%,经调整净利润率为16.9%/+2pct。

这份财报可总结为“3高2快”:毛利高(41.8%)、单店收入高(月营业收入21.1万);拓店速度快(全球门店数量突破6000家),上新快(7天推出100个新品),周转快(67天左右完成一次周转)。

这份财报可总结为“3高2快”:毛利高(41.8%)、单店收入高(月营业收入21.1万);拓店速度快(全球门店数量突破6000家),上新快(7天推出100个新品),周转快(67天左右完成一次周转)。

各运营指标的积极表现,标志着名创优品在运营效率、市场响应速度、创新能力方面都达到了历史性高度的黄金阶段。

然而,业绩公布次日,公司股价却出现下跌。

在亮眼的财报数据背后,隐藏着市场对增速的担忧。

国内直营占比未见起色、自研IP存在感进一步削弱、海外拓店速度不及预期......都为这个小商品帝国的未来增长路径蒙上一层不确定性的阴影。

全球门店数量突破6000家,直营仅231家

跑通一个单店模型,然后快速复制,这就是零售店增长的根本模式。名创优品正处在这个快速复制、飞速成长的阶段。

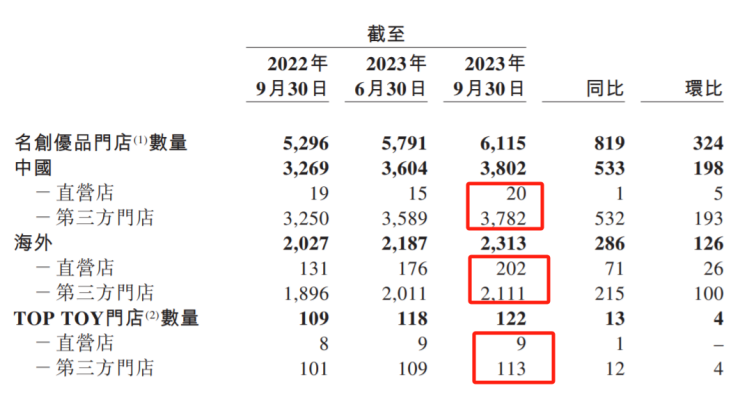

财报期内期间内,名创优品门店数继续狂飙。国内门店数3802家,净增533家,环比净增198家,提前一个季度完成全年国内净增长350到450家门店的目标,并实现全球门店数量突破6000家这一重要里程碑。

在名创优品全球6000多家门店中,只有231家门店是直营店,其余均采用第三方代理模式。

直营模式的占比过低是名创优品一直以来被诟病的。

(资料来源:名创优品FY24Q1季报)

虽然代理模式可以有效地将运营风险转移给代理商,减轻公司自身的管理负担,但这种策略也意味着必须与代理商共享利润,从而导致单个门店的利润率低于直营模式。

因此,许多零售品牌会在重点市场选择直营模式以保持品牌质量的一致性和控制产品标准,而在追求快速扩张的市场采用代理模式。

名创优品虽然也对外宣称重视直营市场,将其视为重要的增长驱动力,但最新季度报告中显示,代理模式仍占据压倒性的地位。

根据Q3的数据,名创优品在国内的直营门店数量为20家,相比去年同期仅增加了5家,而与此同时,第三方门店的数量增加了193家。

如何在维持品牌质量和提升利润率的同时,实现快速且可持续的市场扩张,仍是其未来发展的关键。这也需要名创优品在直营和代理模式之间找到一个更加平衡的组合。

拓店速度、单店收入齐升,名创优品正处于黄金发展期

令人惊喜的是,名创优品在拓店速度如此之快的情况下,平均单店收入仍实现了同比23.8%的增长,也带动了其中国线下门店总收入的同比增长41.2%。

在电话会中,名创优品详细阐述了其实现同店持续增长的关键因素:

一个是名创优品始终强调的“开大店”。虽然大店的投入是普通门店的2倍左右,但由于客单价高,人流量大,单店店销反而更好。

今年以来,名创优品在全球范围内的多个“超级大店”如纽约时代广场旗舰店、广州北京路旗舰店、赣州城市形象店都获得了亮眼的业绩表现。

在本季度,名创优品继续扩大其“超级大店”的网络,西安大唐不夜城店、武汉楚河汉界万达店等新开的超级门店对公司整体业绩产生了积极的拉动。

尝到甜头的名创优品还计划将“超级大店”开到意大利罗马、法国巴黎、西班牙马德里等国际大城市。

此外,大美妆、大IP、大玩具等兴趣消费也一直是名创优品的重点投入。这类品类的毛利率在60%左右,溢价空间大,是提升整体毛利的关键。

例如,本季度名创优品与芭比、Loopy等品牌的联名款产品热销出圈,成为业绩增长的重要驱动力。在国内销售额破千万的产品中,60%左右来自于兴趣消费。

然而,值得关注的是,尽管联名IP在短期内对品牌销量和盈利有显著提升作用,但“过分依赖外部IP”这一标签也一直伴随着名创优品。

公司也意识到了这一点,多次强调将自研IP视作重要战略方向。但从本季度数据来看,名创优品自研IP品牌销售额占比在进一步下降。

这也需要名创优品引起更高的警示,要真正打造一个具有持久吸引力的“超级品牌”,名创优品必须要有自己的“loopy”。

费用方面,随着名创优品品牌升级、大型门店的开设、广告开支的增加,以及IP库扩大和IP产品种类的丰富化,相关的授权费用增加,本季度销售及分销开支为人民币640.9百万元( 87.8百万美元),同比增长68.1%。

根据公司的财务预测,下一季度销售费用预计将继续呈上升趋势。

随着名创优品收入规模的扩张,固定成本不变,额外的销售额将产生更高的利润率。经营杠杆的释放对冲费用上升的风险,整体的增长还是可控的。

海外市场有喜有忧

出海是名创优品的另一个故事,也是市场看重的方向。

今年泡泡玛特、名创优品在中概股中优异的表现,共性便是国货出海逻辑。产品出海意味着企业目标客群将新增海外市场,天花板大大提升,在新市场上实现市占率增长的可能性更加明确。

海外市场也为本季度财报提供了不少亮点。海外业务收入近13亿,在去年同期的高基数之上,同比增长近41%,刷新海外业务三季度销售的最高历史记录。

主要海外市场仍保持GMV高速增长,北美区域同比增长近1.6倍,拉美市场同比增长近60%,欧洲市场同比增长近50%。

特别值得注意的是,名创优品海外直营市场的收入同比增长接近89%,在海外总收入中的占比从去年同期的34%上升至约46%。

这是一个积极的迹象,并且名创优品还表示,“明年最大的机会就是海外直营市场。”

但在拓店速度上,海外市场似乎难以与国内市场相比。

上半年名创优品在海外开店缓慢,尽管在第三季度加快了开店速度,净增加了126个门店,但截至2023年9月30日,海外市场的累计净增门店数为198家,这与年初设定的350至450家的开店目标相比,仅完成了大约一半的任务。要在一个季度内完成剩余目标难度不小。

在历史上,许多零售企业在经历了快速扩张阶段(如大规模开设新门店)之后,当期业绩好看,但常常面临新店铺人流量下滑的问题,造成盈利拖累。市场或许也在担忧名创优品也遭遇类似情况,高增长难以持续。

尽管名创优品立下豪言明年将在海外市场开出更多门店,但在下行周期下公司的扩张速度与质量如何,也仍是未知数。