Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Zhuhai Enpower ElectricLtd share price has climbed 62% in five years, easily topping the market return of 37% (ignoring dividends).

Since the long term performance has been good but there's been a recent pullback of 6.9%, let's check if the fundamentals match the share price.

View our latest analysis for Zhuhai Enpower ElectricLtd

While Zhuhai Enpower ElectricLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

While Zhuhai Enpower ElectricLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Zhuhai Enpower ElectricLtd can boast revenue growth at a rate of 37% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 10% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Zhuhai Enpower ElectricLtd. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

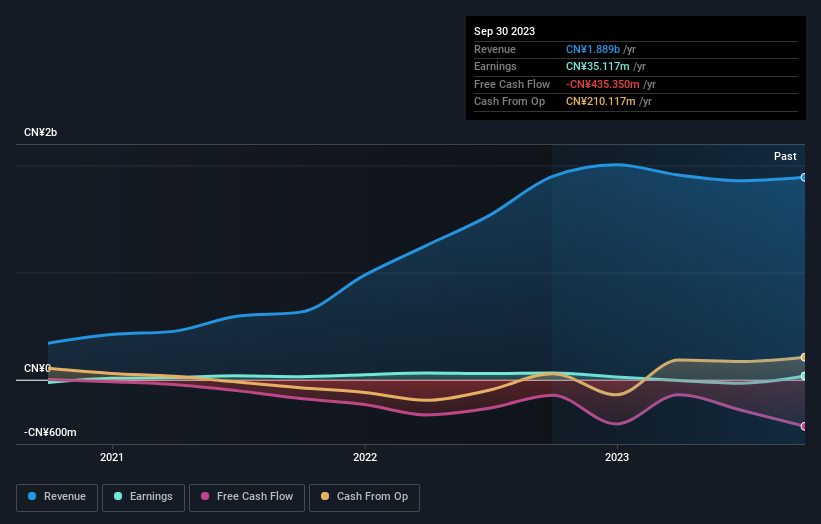

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Zhuhai Enpower ElectricLtd's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 3.4% in the twelve months, Zhuhai Enpower ElectricLtd shareholders did even worse, losing 25% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 10%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Zhuhai Enpower ElectricLtd (1 is potentially serious) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.