Insiders At Stifel Financial Sold US$5.0m In Stock, Alluding To Potential Weakness

Insiders At Stifel Financial Sold US$5.0m In Stock, Alluding To Potential Weakness

Over the past year, many Stifel Financial Corp. (NYSE:SF) insiders sold a significant stake in the company which may have piqued investors' interest. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

在過去的一年中,許多Stifel Financial Corp.(紐約證券交易所代碼:SF)內部人士出售了該公司的大量股份,這可能激起了投資者的興趣。在評估內幕交易時,了解內部人士是否在買入通常更有幫助,因爲內幕賣出可能有多種解釋。但是,當多位內部人士在特定期限內出售股票時,股東應注意,因爲這可能是一個危險信號。

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

儘管我們認爲股東不應乾脆關注內幕交易,但我們認爲完全忽視內幕交易是愚蠢的。

View our latest analysis for Stifel Financial

查看我們對 Stifel Financial 的最新分析

Stifel Financial Insider Transactions Over The Last Year

過去一年的Stifel Financial Insider交易

In the last twelve months, the biggest single sale by an insider was when the Senior VP, Thomas Michaud, sold US$3.5m worth of shares at a price of US$58.85 per share. That means that an insider was selling shares at slightly below the current price (US$62.14). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 37% of Thomas Michaud's holding.

在過去的十二個月中,內部人士最大的一次出售是高級副總裁托馬斯·邁克肖德以每股58.85美元的價格出售了價值350萬美元的股票。這意味着一位內部人士以略低於當前價格(62.14美元)的價格出售股票。通常,當內部人士以低於當前價格的價格出售時,我們認爲這會令人沮喪,因爲這表明他們對較低的估值感到滿意。儘管內幕拋售不是一個積極的信號,但我們無法確定這是否意味着內部人士認爲股票已被充分估值,因此這只是一個弱勢信號。我們注意到,最大的單筆銷售僅爲托馬斯·邁克肖德持股的37%。

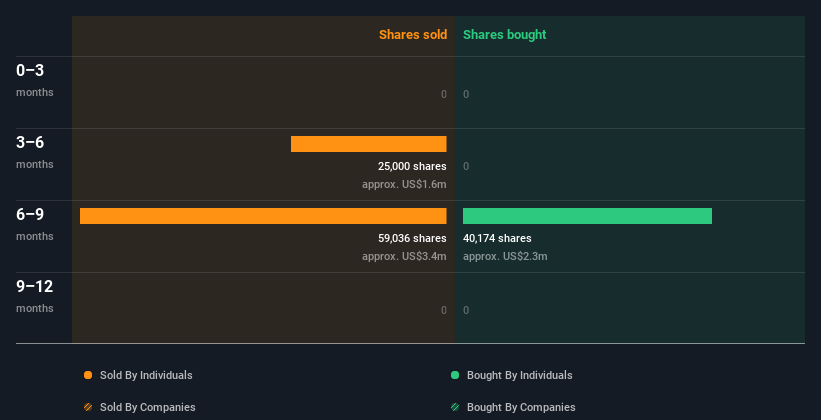

In the last twelve months insiders purchased 40.17k shares for US$2.3m. But they sold 84.04k shares for US$5.0m. All up, insiders sold more shares in Stifel Financial than they bought, over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

在過去的十二個月中,內部人士以230萬美元的價格購買了40.17萬股股票。但他們以500萬美元的價格出售了8.404萬股股票。總而言之,去年內部人士出售的Stifel Financial股票多於他們購買的股份。下圖顯示了去年的內幕交易(公司和個人)。點擊下圖,你可以看到每筆內幕交易的確切細節!

I will like Stifel Financial better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

如果我看到一些大規模的內幕買入,我會更喜歡Stifel Financial。在我們等待的同時,請查看這份免費名單,列出了最近有大量內幕買入的成長型公司。

Insider Ownership Of Stifel Financial

斯蒂菲爾金融的內部所有權

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Stifel Financial insiders own 3.6% of the company, currently worth about US$227m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

查看公司的內部人持股總額可以幫助您了解他們是否與普通股股東保持良好關係。我們通常希望看到相當高的內部所有權水平。Stifel Financial內部人士擁有該公司3.6%的股份,根據最近的股價,目前價值約爲2.27億美元。內部人士持有這種重大所有權通常會增加公司爲所有股東的利益而經營的機會。

So What Does This Data Suggest About Stifel Financial Insiders?

那麼這些數據對Stifel Financial Insiders有何啓示呢?

There haven't been any insider transactions in the last three months -- that doesn't mean much. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Stifel Financial insider transactions don't fill us with confidence. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. While conducting our analysis, we found that Stifel Financial has 1 warning sign and it would be unwise to ignore this.

在過去的三個月中,沒有任何內幕交易——這並不意味着什麼。令人鼓舞的是,內部人士擁有大量股票,但我們希望看到更多的內幕買盤,因爲去年Stifel Financial的內幕交易並沒有使我們充滿信心。雖然我們喜歡了解內部人士的所有權和交易情況,但在做出任何投資決定之前,我們也一定要考慮股票面臨的風險。在進行分析時,我們發現Stifel Financial有1個警告信號,忽視這一點是不明智的。

But note: Stifel Financial may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但請注意:Stifel Financial可能不是最值得買入的股票。因此,來看看這份免費列出的投資回報率高、債務低的有趣公司的名單。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

就本文而言,內部人士是指向相關監管機構報告其交易的個人。我們目前只考慮公開市場交易和私下處置的直接利益,不包括衍生品交易或間接權益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

In the last twelve months, the biggest single sale by an insider was when the Senior VP, Thomas Michaud, sold US$3.5m worth of shares at a price of US$58.85 per share. That means that an insider was selling shares at slightly below the current price (US$62.14). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 37% of Thomas Michaud's holding.

In the last twelve months, the biggest single sale by an insider was when the Senior VP, Thomas Michaud, sold US$3.5m worth of shares at a price of US$58.85 per share. That means that an insider was selling shares at slightly below the current price (US$62.14). As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. We note that the biggest single sale was only 37% of Thomas Michaud's holding.