Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Royal Caribbean Cruises Ltd. (NYSE:RCL) share price is up 80% in the last 1 year, clearly besting the market return of around 14% (not including dividends). So that should have shareholders smiling. It is also impressive that the stock is up 33% over three years, adding to the sense that it is a real winner.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Royal Caribbean Cruises

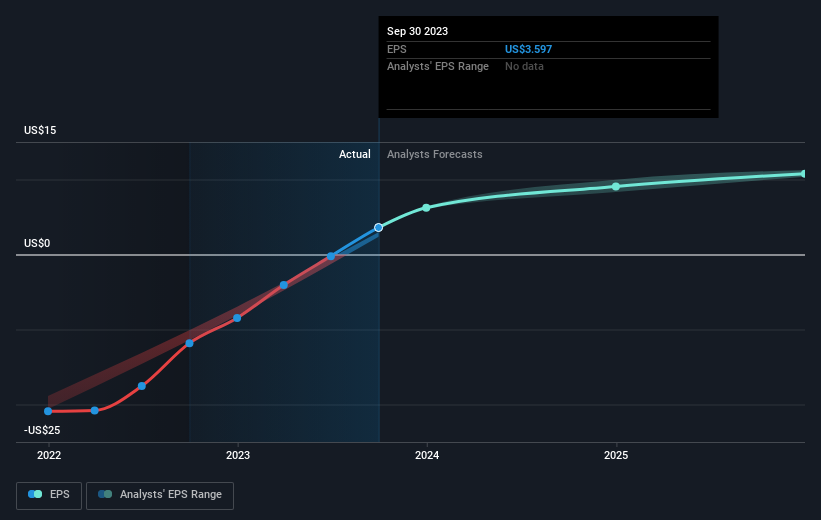

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Royal Caribbean Cruises grew its earnings per share, moving from a loss to a profit.

We think the growth looks very prospective, so we're not surprised the market liked it too. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

NYSE:RCL Earnings Per Share Growth November 27th 2023

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Royal Caribbean Cruises has rewarded shareholders with a total shareholder return of 80% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 0.9% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Royal Caribbean Cruises (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.