David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Addsino Co., Ltd. (SZSE:000547) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Addsino

What Is Addsino's Debt?

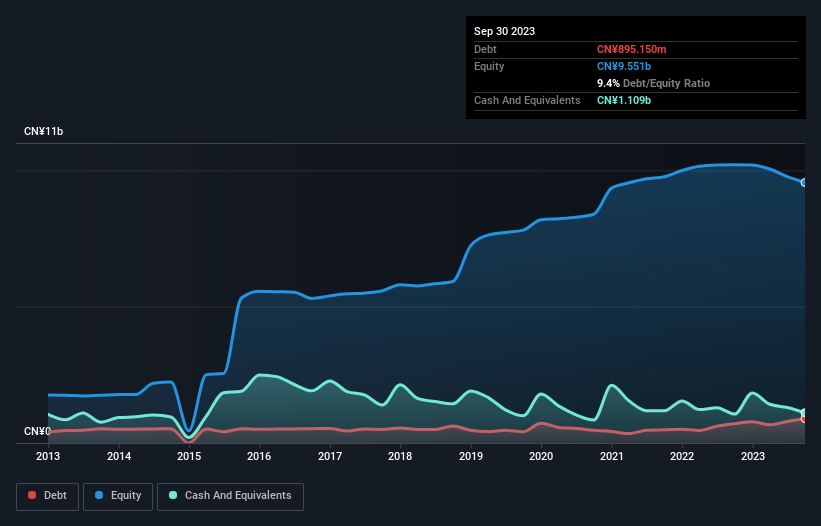

The image below, which you can click on for greater detail, shows that at September 2023 Addsino had debt of CN¥895.1m, up from CN¥710.4m in one year. However, its balance sheet shows it holds CN¥1.11b in cash, so it actually has CN¥213.8m net cash.

The image below, which you can click on for greater detail, shows that at September 2023 Addsino had debt of CN¥895.1m, up from CN¥710.4m in one year. However, its balance sheet shows it holds CN¥1.11b in cash, so it actually has CN¥213.8m net cash.

A Look At Addsino's Liabilities

According to the last reported balance sheet, Addsino had liabilities of CN¥4.02b due within 12 months, and liabilities of CN¥309.6m due beyond 12 months. On the other hand, it had cash of CN¥1.11b and CN¥3.60b worth of receivables due within a year. So it actually has CN¥384.1m more liquid assets than total liabilities.

This surplus suggests that Addsino has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Addsino boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Addsino's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Addsino had a loss before interest and tax, and actually shrunk its revenue by 25%, to CN¥2.5b. That makes us nervous, to say the least.

So How Risky Is Addsino?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Addsino had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CN¥163m of cash and made a loss of CN¥682m. With only CN¥213.8m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like Addsino I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.