月曜日、米国の取引高第1位はテスラで、株価は0.27%上昇し、取引額は262.74億ドルに達しました。テスラの役員の1人は、同社が待望のサイバートラックの引き渡し式を開催する予定であり、中部時間11月30日(週四)午後1時(日本時間週五午前3時)にテキサス州のスーパーファクトリで行うと述べました。

報道によると、11月25日、テスラの車が成都で11台の車両と衝突し、3人が負傷し、複数の車が損壊した。現在、事故を起こした車のオーナーは、原因がテスラの自動車にあると公然と主張しています。

テスラ社は11月27日(月曜日)、事故車両が警察に押収され、同社は今後も警察および関連部署が事故の認定に必要な調査を進めるために協力していくと回答しました。また、関連する車両データを提出するよう協力していくものとしています。最終的な事故全容および責任の所在は、交通警察の報告書によって確定されます。

2番目はNvidiaで、株価は0.98%上昇し、189.78億ドルの取引が行われました。これにより、3日間続いた下落相場が終わりました。

3番目はBroadcomで、株価は2.92%下落し、取引額は91.74億ドルに達しました。中国国家市場監督管理総局から暫定的な許可を得た後、Broadcom社は、先週水曜日にクラウドコンピューティング企業Vmwareを690億ドルで買収する取引を完了しました。

Broadcomは11月22日に声明を発表し、Vmwareの買収を完了したことを発表しました。Vmwareの普通株は、ニューヨーク証券取引所での取引が停止しました。

この取引は、2022年5月に発表されたもので、世界で2番目に大きな技術業界の買収案となり、MicrosoftによるActivision Blizzardの690億ドル買収案に次ぐものでした。

しかし、この取引は世界中で厳格な規制監査への対象となったため、両社は取引完了日を3回延期しています。

第4位はMicrosoftで、株価は0.31%上昇し、史上最高の終値である378.61ドルで終わり、取引額は83.8億ドルに達しました。今日は、Microsoftは380.64ドルまで上昇し、過去最高値を更新しました。

アナリストのFatima Boolaniは研究レポートを公表し、Microsoftの年次Igniteカンファレンスを評価しています。このアナリストによると、Microsoftのネットワークセキュリティ部門にとって、このカンファレンスは情報伝達を「微調整」することが多く、革新的な製品を発表することはありません。

Boolaniは、「Varonis Systems(VRNS.US)、AvePoint(AVPT.US)などの企業に影響を与えるデータセキュリティの問題に注目する以外に、この大会で最も強調されたテーマは、Microsoftのエコシステムとの「統合」である」と述べました。

Boolaniは、「このような統合的な議論は、Microsoftがネットワーク分野での中核的な価値物をより強固にすることに役立ち、Palo Alto Networks(PANW.US)、Zscaler(ZS.US)およびCrowdStrike(CRWD.US)などの主要なネットワークセキュリティプレーヤーとの価格競争/バンドル後果の軽減にはならないものの、世界的な規制違反開示要件、ランサムウェアの拡大、地政学的なリスク、新しいタイプのAIネットワークセキュリティの限界により、ネットワーク予算に上昇圧力がかかるため、友好的な共存の余地がある」と報告書で述べています。

第5位は Amazon で、株価は0.67%上昇し、取引額は776.8億ドルに達しました。欧州委員会は月曜日、AmazonがIrobotを買収する計画は市場競争に損害を与える可能性があると警告しました。

さらに、S&PとAmazon Web Services社が提携を拡大し、S&PはAWS Marketplaceで一部の製品を提供するようになります。

第6位はAppleで、株価は0.09%下落し、取引額は766.7億ドルに達しました。Wedbushのアナリストは先週金曜日(24日)、報告書を発表し、Appleのホリデーシーズン中の販売は堅調であり、中国でのiPhoneへの需要は依然として高いと述べています。同時に、アナリストはAppleのアウトパフォームのレーティングを与え、目標株価を240ドルに設定しました。アナリストらは、最近のネガティブな報道にもかかわらず、Appleのアジアのサプライチェーンを調査した結果、「重要なホリデーシーズンにはApple iPhone 15が非常に堅調で、特に中国では」と述べています。

第8位はMeta Platformsで、株価は1.04%下落し、取引額は526.9億ドルに達しました。アメリカ合衆国の41州の検察官が社交メディア大手META社を一斉に提訴し、同社が未成年のアカウント情報を違法に収集し、未成年者の精神健康を損なうアルゴリズムを採用し続けていると非難しています。

最新の裁判文書によると、Meta社は少なくとも2019年から、13歳未満の子供の多くのアカウントを意図的に閉鎖しないようにしており、親の同意なしに彼らの個人情報を収集しています。さらに、Meta社は、そのアルゴリズムが未成年者の心理的健康に害を及ぼすことを知りつつ、アルゴリズムを変更することを拒否し、これによりアドレナリンの放出を引き起こし、その結果、若いユーザーがプラットフォーム上の依存的な消費循環に陥る可能性があると述べています。

同社はまた、プラットフォーム上での誤った情報、憎悪的な発言、差別およびその他の有害なコンテンツの発生率をうやむやにしたことを非難されています。この訴訟は、法廷にMeta社が上記の違法行為を行わないように命じるよう求めています。Meta社は、FacebookとInstagramという2つの主要なソーシャルメディアプラットフォームを所有しており、数百万人の青少年および子供のユーザーがいます。そのため、民事罰金は数億ドルになる可能性があります。大半の州では、1回あたり1000ドルから5万ドルの罰金が科せられます。

第12位は中概株のPinduoduoで、株価は0.83%下落し、取引額は197.3億ドルに達しました。

第14位はShopifyで、株価は4.89%上昇し、取引額は175.9億ドルに達しました。Shopifyは、ブラックフライデー期間中の世界的な売り上げ高が410億ドルに達し、前年同期比で22%増加し、過去最高を記録しました。ピーク時には、毎分420万ドルの売り上げがありました。その他のデータによると、服装、パーソナルケア、宝石の売り上げが最も急増しました。グローバル平均注文額は110.71ドルで、固定為替レートで110.08ドルです。そして、Shopify POS端末消費は前年同期比で33%増加しました。

米国株の16位Coinbaseの取引量は16.72億ドルで、3.66%の上昇率を示しました。Coinbaseの取締役であるJ Conor Grogan氏は、先週水曜日に、Binanceは米国司法省の43億ドルの罰金を支払うために必要な財務リソースを持っているため、暗号資産を清算する必要はないと述べています。

17位のRokuは、16.53億ドルの取引量で8.48%上昇しました。

20位のAlibabaは、14.04億ドルの取引量で1.22%下落しました。

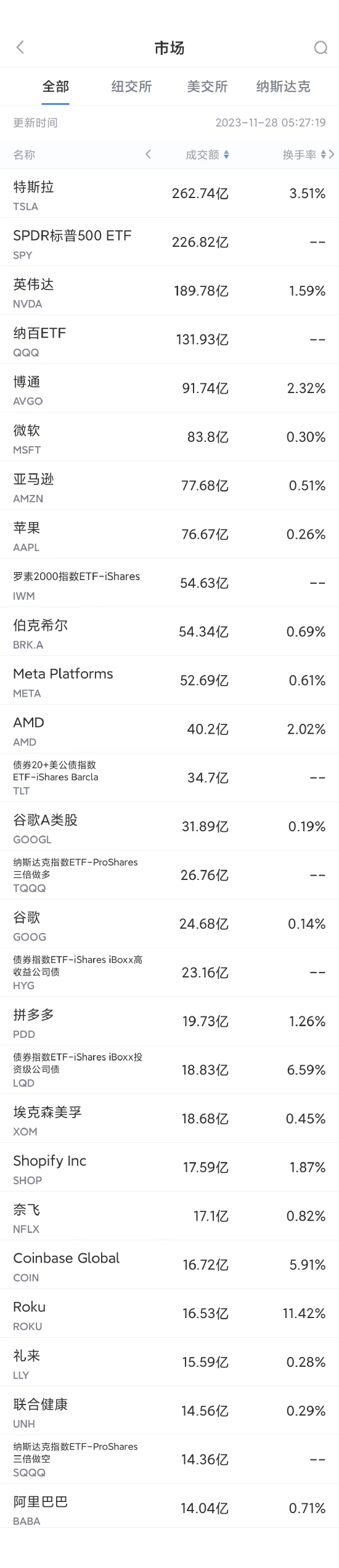

以下は、米国株取引で最も活発な20銘柄(取引高順)です: