The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Shenzhen Soling Industrial Co.,Ltd (SZSE:002766) share price has soared 102% in the last three years. Most would be happy with that. It's also good to see the share price up 20% over the last quarter.

The past week has proven to be lucrative for Shenzhen Soling IndustrialLtd investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for Shenzhen Soling IndustrialLtd

We don't think that Shenzhen Soling IndustrialLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

We don't think that Shenzhen Soling IndustrialLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

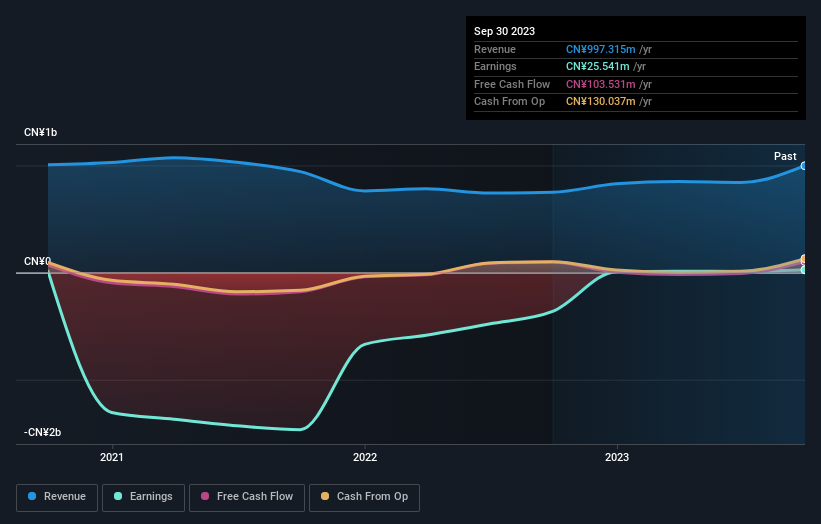

In the last 3 years Shenzhen Soling IndustrialLtd saw its revenue shrink by 7.1% per year. So we wouldn't have expected the share price to gain 26% per year, but it has. It's a good reminder that expectations about the future, not the past history, always impact share prices.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Shenzhen Soling IndustrialLtd shareholders have received a total shareholder return of 10% over one year. There's no doubt those recent returns are much better than the TSR loss of 1.2% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Shenzhen Soling IndustrialLtd better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Shenzhen Soling IndustrialLtd .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.