Investors with a lot of money to spend have taken a bearish stance on Phillips 66 (NYSE:PSX).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PSX, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PSX, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 23 uncommon options trades for Phillips 66.

This isn't normal.

The overall sentiment of these big-money traders is split between 43% bullish and 56%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $239,857, and 19 are calls, for a total amount of $2,310,300.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $105.0 and $145.0 for Phillips 66, spanning the last three months.

Analyzing Volume & Open Interest

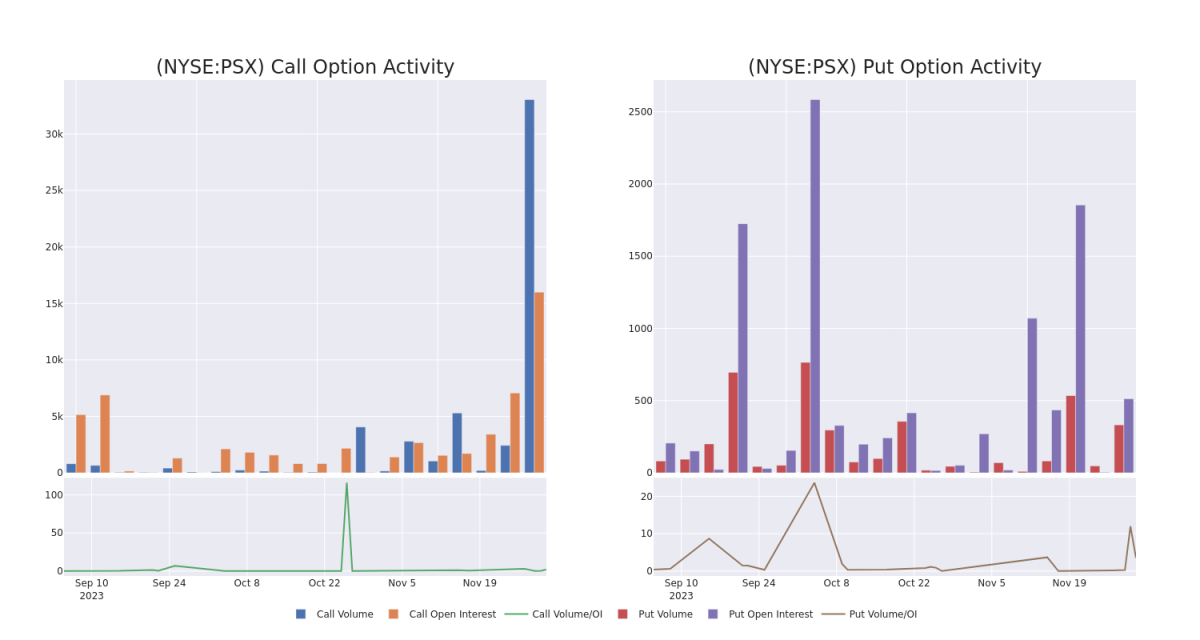

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Phillips 66's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Phillips 66's substantial trades, within a strike price spectrum from $105.0 to $145.0 over the preceding 30 days.

Phillips 66 Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PSX | CALL | SWEEP | BULLISH | 02/16/24 | $135.00 | $618.3K | 10.4K | 3.4K |

| PSX | CALL | SWEEP | BEARISH | 02/16/24 | $135.00 | $416.7K | 10.4K | 1.2K |

| PSX | CALL | SWEEP | BEARISH | 02/16/24 | $135.00 | $160.7K | 10.4K | 3.9K |

| PSX | CALL | SWEEP | BULLISH | 01/19/24 | $105.00 | $134.9K | 1.2K | 50 |

| PSX | CALL | SWEEP | BEARISH | 02/16/24 | $135.00 | $128.7K | 10.4K | 4.6K |

About Phillips 66

Phillips 66 is an independent refiner with 12 refineries that have a total crude throughput capacity of 1.9 million barrels per day, or mmb/d. In 2023, the Rodeo, California, facility will cease operations and be converted to produce renewable diesel. The midstream segment comprises extensive transportation and NGL processing assets and includes DCP Midstream, which holds 600 mbd of NGL fractionation and 22,000 miles of pipeline. Its CPChem chemical joint venture operates facilities in the United States and the Middle East and primarily produces olefins and polyolefins.

Following our analysis of the options activities associated with Phillips 66, we pivot to a closer look at the company's own performance.

Phillips 66's Current Market Status

- Trading volume stands at 2,864,186, with PSX's price up by 0.85%, positioned at $129.99.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 60 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Phillips 66 with Benzinga Pro for real-time alerts.