Virginia National Bankshares Corporation (NASDAQ:VABK) Passed Our Checks, And It's About To Pay A US$0.33 Dividend

Virginia National Bankshares Corporation (NASDAQ:VABK) Passed Our Checks, And It's About To Pay A US$0.33 Dividend

Virginia National Bankshares Corporation (NASDAQ:VABK) stock is about to trade ex-dividend in 4 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. In other words, investors can purchase Virginia National Bankshares' shares before the 7th of December in order to be eligible for the dividend, which will be paid on the 22nd of December.

弗吉尼亞國家銀行股票公司(納斯達克股票代碼:VABK)股票將在4天后進行除息交易。除息日發生在記錄日期的前一天,也就是股東需要在公司賬簿上登記才能獲得股息的日子。除息日很重要,因爲股票的任何交易都需要在記錄日期之前結算,才有資格獲得股息。換句話說,投資者可以在12月7日之前購買弗吉尼亞國家銀行股份公司的股票,以獲得將於12月22日支付的股息。

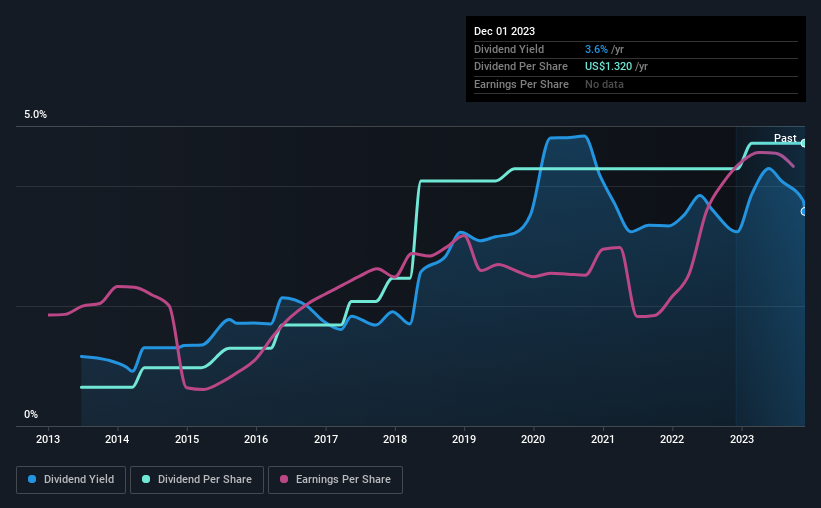

The company's next dividend payment will be US$0.33 per share, on the back of last year when the company paid a total of US$1.32 to shareholders. Calculating the last year's worth of payments shows that Virginia National Bankshares has a trailing yield of 3.6% on the current share price of $36.91. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Virginia National Bankshares has been able to grow its dividends, or if the dividend might be cut.

該公司的下一次股息將爲每股0.33美元,去年該公司向股東共支付了1.32美元。計算去年的付款額顯示,弗吉尼亞國家銀行股票的收益率爲3.6%,而目前的股價爲36.91美元。股息是許多股東的重要收入來源,但業務的健康狀況對於維持這些股息至關重要。因此,讀者應時刻查看弗吉尼亞國家銀行股份公司是否能夠增加股息,或者股息是否可能被削減。

View our latest analysis for Virginia National Bankshares

查看我們對弗吉尼亞國家銀行股票的最新分析

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Virginia National Bankshares paid out a comfortable 30% of its profit last year.

股息通常由公司利潤支付,因此,如果公司支付的股息超過其收入,則其股息被削減的風險通常更大。去年,弗吉尼亞國家銀行股份公司支付了其利潤的30%。

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

當一家公司支付的股息少於其賺取的利潤時,這通常表明其股息是負擔得起的。它支付的利潤百分比越低,在業務進入低迷時分紅的安全餘地就越大。

Click here to see how much of its profit Virginia National Bankshares paid out over the last 12 months.

點擊此處查看弗吉尼亞國民銀行股份在過去12個月中支付了多少利潤。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see Virginia National Bankshares's earnings per share have risen 12% per annum over the last five years.

增長前景強勁的企業通常是最好的股息支付者,因爲當每股收益改善時,更容易增加股息。如果業務進入低迷狀態並削減股息,該公司的價值可能會急劇下降。出於這個原因,我們很高興看到弗吉尼亞國家銀行股票的每股收益在過去五年中每年增長12%。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Virginia National Bankshares has delivered 22% dividend growth per year on average over the past 10 years. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

大多數投資者評估公司股息前景的主要方法是檢查歷史股息增長率。在過去的10年中,弗吉尼亞國家銀行股份公司的股息平均每年增長22%。最近,每股收益和股息都迅速增長,很高興看到。

The Bottom Line

底線

Has Virginia National Bankshares got what it takes to maintain its dividend payments? Typically, companies that are growing rapidly and paying out a low fraction of earnings are keeping the profits for reinvestment in the business. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. Virginia National Bankshares ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

弗吉尼亞國家銀行股份公司是否具備維持股息支付所需的條件?通常,快速增長且支付的收益比例很低的公司會保留利潤用於業務再投資。從長遠來看,這種策略可以在不發行過多新股的情況下爲股東增加可觀的價值。從股息的角度來看,弗吉尼亞國家銀行股份公司爲我們提供了很多條件,我們認爲這些特徵應該標誌着該公司值得進一步關注。

Curious about whether Virginia National Bankshares has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

想知道弗吉尼亞國家銀行股份公司是否能夠持續實現增長?以下是其歷史收入和收益增長的圖表。

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

如果您在市場上尋找強勁的股息支付者,我們建議您查看我們精選的頂級股息股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Virginia National Bankshares paid out a comfortable 30% of its profit last year.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Virginia National Bankshares paid out a comfortable 30% of its profit last year.