Dalian Sunasia Tourism Holding CO.,LTD (SHSE:600593) shareholders have had their patience rewarded with a 25% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 44%.

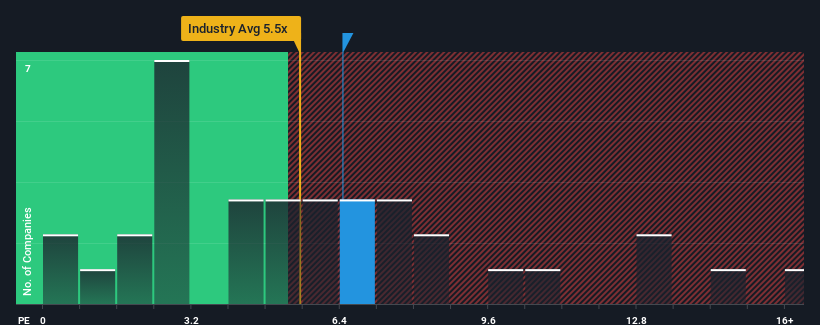

In spite of the firm bounce in price, it's still not a stretch to say that Dalian Sunasia Tourism HoldingLTD's price-to-sales (or "P/S") ratio of 6.5x right now seems quite "middle-of-the-road" compared to the Hospitality industry in China, where the median P/S ratio is around 5.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Dalian Sunasia Tourism HoldingLTD

What Does Dalian Sunasia Tourism HoldingLTD's Recent Performance Look Like?

Dalian Sunasia Tourism HoldingLTD certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Dalian Sunasia Tourism HoldingLTD certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Is There Some Revenue Growth Forecasted For Dalian Sunasia Tourism HoldingLTD?

In order to justify its P/S ratio, Dalian Sunasia Tourism HoldingLTD would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 166% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Dalian Sunasia Tourism HoldingLTD's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Dalian Sunasia Tourism HoldingLTD appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Dalian Sunasia Tourism HoldingLTD's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Dalian Sunasia Tourism HoldingLTD that you should be aware of.

If you're unsure about the strength of Dalian Sunasia Tourism HoldingLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.