Tian Chang Group Holdings Ltd. (HKG:2182) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 25% is also fairly reasonable.

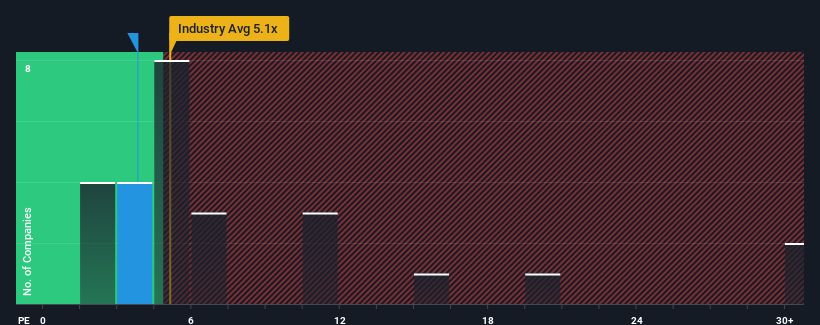

Even after such a large jump in price, Tian Chang Group Holdings' price-to-earnings (or "P/E") ratio of 3.8x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Tian Chang Group Holdings' receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Tian Chang Group Holdings

See our latest analysis for Tian Chang Group Holdings

Is There Any Growth For Tian Chang Group Holdings?

In order to justify its P/E ratio, Tian Chang Group Holdings would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 26%. Regardless, EPS has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Tian Chang Group Holdings' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Shares in Tian Chang Group Holdings are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Tian Chang Group Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Tian Chang Group Holdings you should be aware of.

If these risks are making you reconsider your opinion on Tian Chang Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.