Most readers would already be aware that Sunshine Guojian Pharmaceutical (Shanghai)'s (SHSE:688336) stock increased significantly by 29% over the past three months. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Sunshine Guojian Pharmaceutical (Shanghai)'s ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Sunshine Guojian Pharmaceutical (Shanghai)

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sunshine Guojian Pharmaceutical (Shanghai) is:

4.3% = CN¥206m ÷ CN¥4.8b (Based on the trailing twelve months to September 2023).

The 'return' is the yearly profit. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.04.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Sunshine Guojian Pharmaceutical (Shanghai)'s Earnings Growth And 4.3% ROE

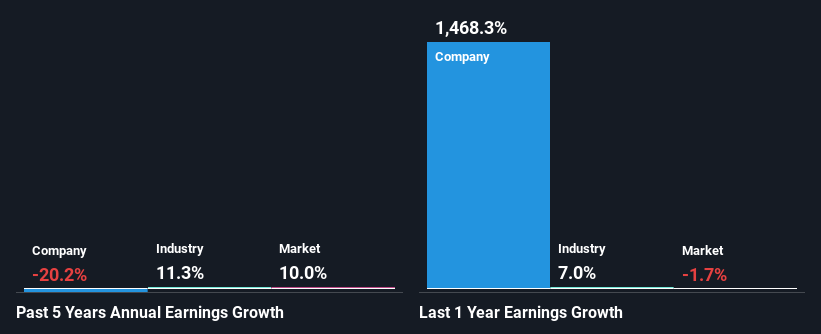

As you can see, Sunshine Guojian Pharmaceutical (Shanghai)'s ROE looks pretty weak. Not just that, even compared to the industry average of 6.6%, the company's ROE is entirely unremarkable. Therefore, it might not be wrong to say that the five year net income decline of 20% seen by Sunshine Guojian Pharmaceutical (Shanghai) was possibly a result of it having a lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

That being said, we compared Sunshine Guojian Pharmaceutical (Shanghai)'s performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 11% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Sunshine Guojian Pharmaceutical (Shanghai) fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Sunshine Guojian Pharmaceutical (Shanghai) Efficiently Re-investing Its Profits?

Sunshine Guojian Pharmaceutical (Shanghai) doesn't pay any dividend, meaning that the company is keeping all of its profits, which makes us wonder why it is retaining its earnings if it can't use them to grow its business. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Conclusion

On the whole, we feel that the performance shown by Sunshine Guojian Pharmaceutical (Shanghai) can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Having said that, we studied the latest analyst forecasts, and found that analysts are expecting the company's earnings growth to improve slightly. Sure enough, this could bring some relief to shareholders. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.